Takes & Tickers – July 10, 2025 [Edition 6]: Amazon’s DeepFleet and the Rise of Robotics-as-a-Service

How Amazon Deployed 1 Million Robots, Launched DeepFleet AI, and Created a New Fulfillment Infrastructure Model to Power Robotics-as-a-Service (RaaS)

Welcome to the sixth edition of Takes & Tickers — a weekly lens on the most strategic moves shaping the global supply chain.

In a market captivated by multi-million dollar pay packages and talent wars — Meta poaching engineers from Apple and OpenAI — Amazon made a quieter but strategically potent move: it deployed its one millionth robot.

I covered the story of Vulcan launch and Amazon had 750k robots at that time (deployed). That was May 15, 2025. We are two months out and we have another 250k robots deployed. This is insane.

This essay argues that we are at an inflection point. Amazon is no longer just a retailer or cloud provider. With the introduction of DeepFleet, its generative AI foundation model for warehouse robotics, Amazon is positioned to launch Robotics-as-a-Service (RaaS) — a new category with the potential to rival how Prime-as-a-Service redefined fulfillment.

Through “Prime” Amazon offered its logistics and payments infrastructure to third-party sellers which created a new revenue model, expanded seller autonomy, and fortified Amazon’s logistics dominance.

DeepFleet opens a similar path, this time for robotics infrastructure.

RaaS is a a model where robotics infrastructure — hardware, software, AI coordination, and maintenance — is offered on a subscription or usage basis rather than owned outright by the customer. This enables companies to scale automation without heavy upfront capital investment.

I make a prediction based on Amazon's "infrastructure unbundling strategy" — a business approach where Amazon commercializes internal capabilities originally built for its own scale (as seen with AWS, FBA, and Buy with Prime). Following this playbook, I predict Amazon will offer its robotic fleet, AI orchestration layer, and real-time fulfillment logic as a service, and that retailers and warehouse operators — regardless of whether they sell on Amazon — could tap into this infrastructure to unlock faster, more intelligent fulfillment.

Amazon’s Millionth Robot

“We’ve just deployed our 1 millionth robot... building on our position as the world’s largest manufacturer and operator of mobile robotics.” – Amazon Newsroom

Historically, robots in Amazon’s fulfillment centers played supportive roles — moving shelves to human pickers, aiding in sortation and routing. But the narrative has shifted. With Amazon reaching 1:1 ratio of humans to robots the state of supply chain autonomy is in sight.

I wrote in How Physical AI is Giving Amazon Fulfillment Edge:

As outlined by NVIDIA’s concept of Generative Physical AI, the ability for robots to not only perceive but interpret and act on sensory input—such as touch—is essential for autonomous decision-making in dynamic environments.

With Vulcan, Amazon has introduced this tactile capability, allowing robots to understand contact, pressure, and material interaction in real time.

This basically answers the deeper question: What does a million robots achieve if they aren’t intelligently orchestrated? Amazon answers with DeepFleet.

I don't want to get ahead of myself, but the reality is that physical AI penetration in warehouses is still below 5%. That could change by the end of this year or early next, especially with Amazon likely pushing for faster delivery ahead of the next Prime season.

Amazon DeepFleet: Physical AI at Scale

DeepFleet is the central intelligence layer coordinating robotic movement across more than 300 Amazon facilities. Developed on AWS SageMaker, it uses historical path data to optimize travel time and minimize congestion. Amazon claims a 10% reduction in intra-warehouse travel time, a substantial gain in environments processing millions of orders.

This orchestration unlocks:

Higher throughput at smaller, decentralized fulfillment nodes

SKU diversification closer to demand centers

Higher rates of regional fulfillment, improving delivery speed and cost-efficiency

Strategically, DeepFleet is Amazon’s entry point into Physical AI — the real-world counterpart to digital large language models. Where ChatGPT synthesizes knowledge, DeepFleet synthesizes motion, timing, and coordination.

The ability to offer RaaS hinges on providing value on three fundamental supply chain pillars: efficiency, resilience, and prominence. If DeepFleet can provide value across these three categories it can create a disruptive 1solution. DeepFleet contributes meaningfully across all three:

First…

Efficiency is enhanced by reducing congestion, accelerating pick-and-stow cycles, and improving throughput. Robots working in tandem with human labor increase fulfillment speed and reduce operational costs.

From WSJ: Amazon is also rolling out artificial intelligence in its warehouses, Chief Executive Andy Jassy said recently, “to improve inventory placement, demand forecasting, and the efficiency of our robots.” Amazon said it will cut the size of its total workforce in the next several years.

Amazon's warehouse productivity — already up 25% due to automation — still shows room for AI-led gains. Robots currently process 224 units per hour versus 243 for human workers, but AI is closing that gap.

By improving inventory placement, demand forecasting, and task orchestration, Amazon can raise throughput another 5–10%, particularly by using DeepFleet and AWS-powered models.

The shift enables leaner headcounts while increasing fulfillment speed and consistency. Strategically, this reinforces Amazon’s lead in intelligent warehousing, allowing it to scale precision without proportional labor growth.

More robots don’t require equivalent human supervision. This means Amazon can double fulfillment with less than double the cost.

Second…

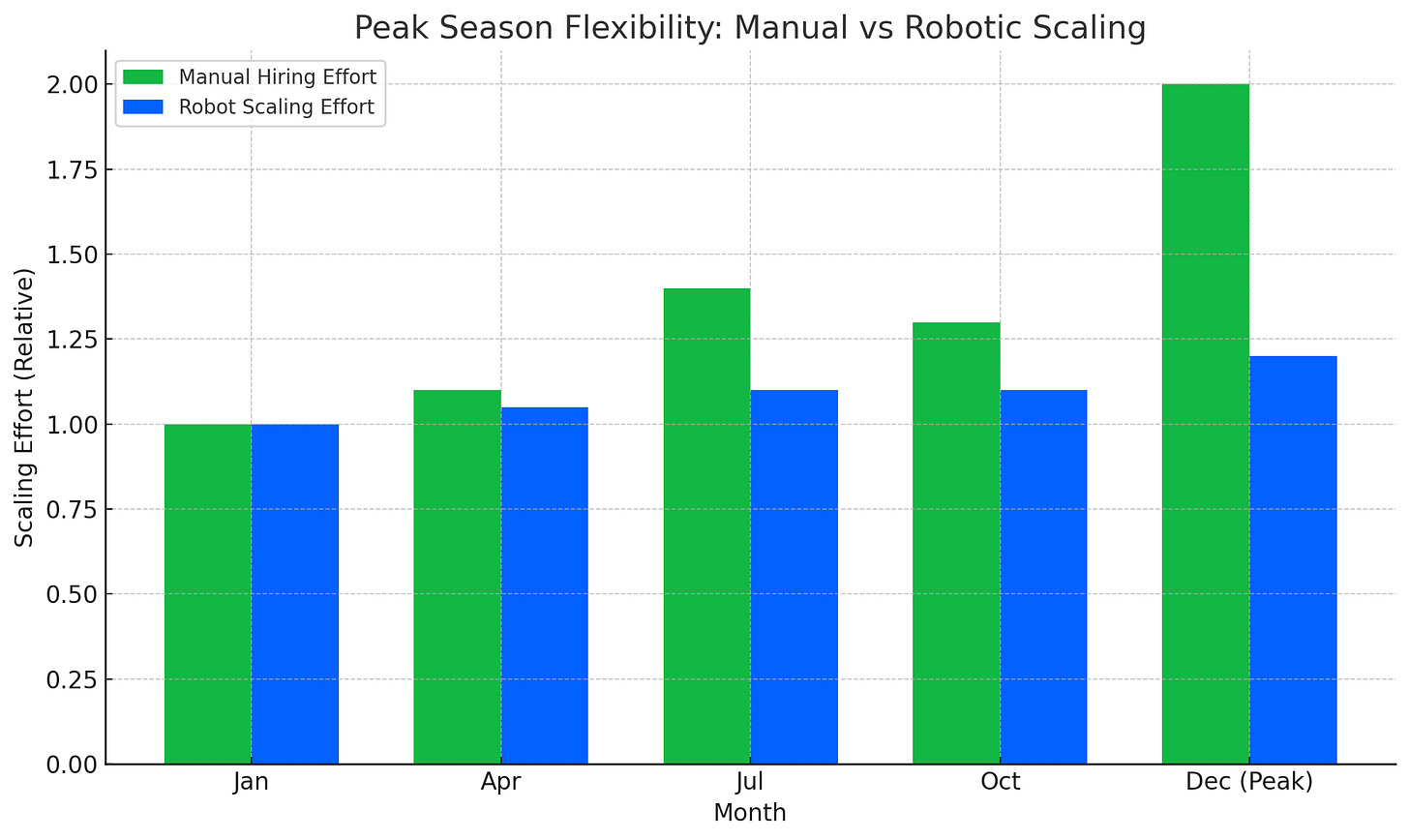

Resilience is achieved by mitigating the impact of labor disruptions, strikes, or seasonal demand spikes. A scalable robotic workforce builds flexibility and redundancy into Amazon’s network.

From WSJ: Some of Amazon’s newer facilities, such as those built for same-day delivery, have “smaller employee footprints and help us deliver with greater speed,” a company spokesman said.

Robots don’t require training or hiring cycles. Amazon can instantly scale up or reconfigure workflows.

Third…

Prominence is earned through faster delivery speeds, environmental sustainability via electrified fleets, and workforce upskilling. Unlike efficiency (internal) or resilience (operational continuity), prominence shapes how customers and competitors perceive value.

This creates a halo effect — customers associate Amazon’s delivery promises with reliability and innovation, while competitors are forced to explain why they can’t match it.

The Strategic Moat

Robots now assist in 75% of Amazon orders, creating a feedback loop of data across facilities. This scale of data is Amazon’s competitive advantage. With DeepFleet, Amazon can:

Phase out manual roles where robots outperform humans in precision or speed

Build resilience against labor shortages, strikes, and peak season surges

Reduce emissions via electrified fleets and optimized routing

Train human workers for higher-order maintenance and oversight tasks

More importantly, DeepFleet positions Amazon to monetize robotics outside its own ecosystem:

Warehouse-as-a-Service:

Offering localized inventory storage and fulfillment to third-party brands. This is already happening through “FBA” program. This strategic moat deepens when benchmarked against the automation capabilities of competitors like Walmart, Alibaba, JD.com, and Target, where Amazon’s integration of robotics and AI gives it a significant operational edge.

Robotics-as-a-Service Platform:

Bundling hardware, maintenance, and DeepFleet’s AI as a subscription product creates a foundation for vertical AI applications — solutions deeply embedded in specific industry workflows.

Amazon is uniquely positioned to lead in vertical AI because of its full-stack ownership across fulfillment, cloud infrastructure (AWS), robotics, and customer data.

With DeepFleet, Amazon not only controls the physical layer (robots, sensors, facility layout) but also the decision layer (AI orchestration, path optimization) and the infrastructure layer (SageMaker, real-time data pipelines).

This enables Amazon to build highly specific AI systems tuned for use cases like retail restocking, grocery fulfillment, apparel handling, or pharmaceutical logistics—far beyond the capabilities of generic robotics platforms.

The vertical nature of DeepFleet is that it understands the constraints of its environment, is trained on real operational data, and continuously improves based on millions of interactions per day — something no third-party RaaS vendor can match at this scale or specificity.

I highlighted the process of creating a “Strategic Framework for Transitioning to Autonomous Logistics”.

This creates a multi-tiered revenue engine: robot sales + maintenance contracts + AI orchestration SaaS — an industrial equivalent to how Amazon monetized AWS.

From Fulfillment to Personalization

With a robotic foundation, Amazon edges closer to personalized fulfillment at scale. Predictive inventory placement powered by robotic responsiveness enables hyperlocal logistics — fulfilling not just fast, but intelligently.

This would be hard for competitors like Walmart, Shopify, or even logistics-first players like UPS to replicate, due to Amazon’s vertical integration2.

Amazon is one of the most vertically integrated players in global commerce. It owns and operates the following critical layers:

Infrastructure: Data centers, cloud computing (AWS), robotics, and internal software platforms.

Logistics: Warehouses, fulfillment centers, sortation hubs, delivery vans, airplanes, and cargo networks.

Retail platform: First-party sales, third-party marketplace, and checkout infrastructure.

Payments and finance: Amazon Pay, merchant financing, and wallet services.

Last-mile fulfillment: Amazon Flex drivers, branded delivery networks, and Prime Now capabilities.

Robotics and AI: In-house robotics hardware (e.g., Proteus, Hercules), DeepFleet orchestration, and simulation platforms.

Amazon’s ability to coordinate warehouse robots with DeepFleet and leverage real-time inventory data from its own fulfillment network gives it a massive advantage. It controls not only how orders are packed and shipped, but also the AI models that optimize those operations.

Unlike competitors who rely on outsourced logistics (Shopify uses Flexport, UPS, or Deliverr; Walmart partners with various 3PLs), Amazon builds the full stack—from hardware to software to fulfillment. This makes it exponentially harder for others to replicate the precision, responsiveness, and scale of Amazon’s fulfillment engine.

This is why DeepFleet can unlock personalized fulfillment and localized inventory strategies—because Amazon owns the robots, the fulfillment centers, the delivery network, and the intelligence layer in between.

Footnotes

Disruptive, in the sense articulated by the late Professor Clayton Christensen, means delivering a solution to an overlooked need—where key players either ignore the opportunity or lack the infrastructure and capital to pursue it. Robotics is one such space: capital-intensive, infrastructure-heavy, and technologically niche. Amazon not only possesses the scale to absorb these costs, but also a deep understanding of the common warehousing challenges faced across industries. This makes it uniquely positioned to offer robotics as a vertical service, similar in form and strategy to Prime-as-a-Service. Read more here.

Vertical integration refers to a company’s ownership and control over multiple stages of its supply chain — from production to distribution. Rather than relying on external vendors or service providers, a vertically integrated firm builds or acquires the capabilities in-house. This reduces dependency, increases control, improves speed, and can reduce costs over time.