AI in the Supply Chain – Use Case 2: How Physical AI Is Giving Amazon a Fulfillment Edge

A deep dive into Amazon’s Vulcan robot, how it compares to Walmart and other retailers, and why Amazon is shaping the future of warehouse automation

Hey, Nikhil here—welcome to The Silk Road Nexus. Twice a week, I unpack what’s shaping the world of supply chain—from deep dives on strategy and optimization to real stories from the frontlines of global commerce.

If this is your first read, you’re right on time to join a growing circle of operators, thinkers, and builders reimagining how the world moves.

The Sixth Sense of Commerce: Physical AI in Warehousing and Amazon’s Vulcan

Amazon's Vulcan robot can now pick, stow, and touch. With this advancement, the physical limits of what robots can do in warehouses are being redrawn. This is no longer about seeing or hearing through cameras and sensors. Physical AI is the new frontier—one where machines interact with the world as humans do.

Vulcan is Amazon’s first robot to combine fine dexterity with tactile sensing, enabling true general-purpose manipulation—far beyond the limitations of earlier systems that relied on suction-based picking, rigid handling, or simple transport tasks. In the broader context of warehouse automation, sensing is the gateway to intelligence.

As outlined by NVIDIA’s concept of Generative Physical AI, the ability for robots to not only perceive but interpret and act on sensory input—such as touch—is essential for autonomous decision-making in dynamic environments.

With Vulcan, Amazon has introduced this tactile capability, allowing robots to understand contact, pressure, and material interaction in real time.

This marks a fundamental shift from rule-based automation to adaptive execution, laying the foundation for warehouse systems that can self-correct, generalize across tasks, and operate effectively in unstructured settings with minimal human intervention.

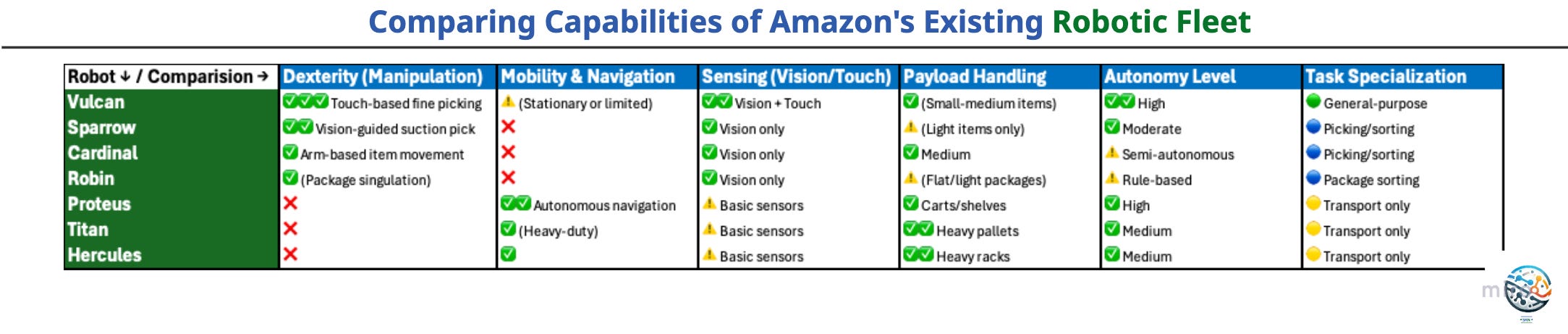

Amazon’s other robots and quick comparison of their capabilities.

Sparrow, Cardinal, and Robin focus on narrow manipulation tasks using vision and suction, and lack tactile feedback—limiting adaptability.

Proteus, Titan, and Hercules are power movers: they shine in mobility and load-bearing but can’t manipulate objects or make nuanced decisions.

Roughly 70% of warehouse automation use cases today are digital—software-based solutions like inventory tracking, WMS platforms, and demand forecasting. The remaining 30%, involving physical manipulation, heavy lifting, and real-world dexterity, remains under-automated.

This gap is no longer due to lack of imagination, but lack of capability. Vulcan changes that.

One of the most impactful use cases Amazon will likely advance with Vulcan is maximizing bin utilization. With AGI-like reasoning, Vulcan could soon identify open space within a bin, evaluate item dimensions in real time, and determine the optimal fit—ensuring every cubic inch is used efficiently. It’s only a matter of time before this becomes operational reality.

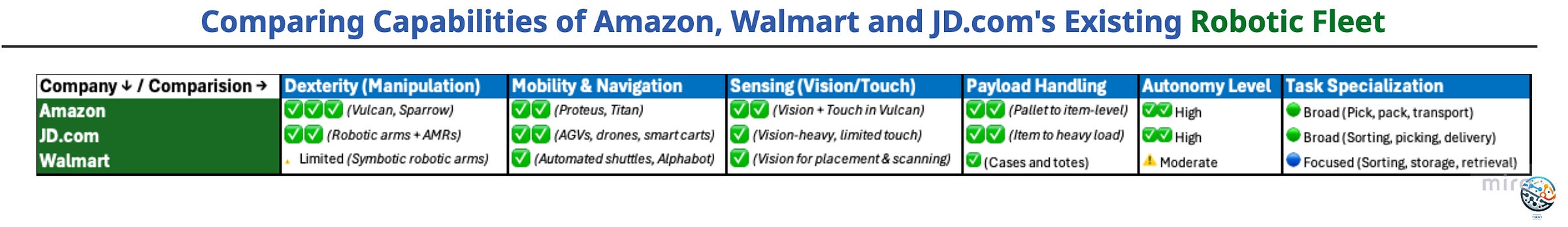

Amazon vs. Walmart: A Tale of Two Automation Strategies

Amazon has over 750,000 robots deployed across its network. Vulcan, its most advanced, is capable of sensing, gripping, and manipulating objects with a level of dexterity once thought to be impossible. These bots are already deployed in warehouses across the U.S. and are reshaping labor allocation, throughput speed, and storage density.

Amazon's Vulcan robot is a breakthrough in physical AI. With tactile sensing, it can navigate cluttered environments and manipulate items like a human hand. This enables it to handle up to 75% of goods in Amazon's warehouses. That level of general-purpose capability is not only rare—it is transformative.

Walmart, in contrast, has focused more on digital warehouse automation and fixed-infrastructure robotics. It has made investments through Symbotic and Alphabot, but these solutions are designed for structured workflows and lack the adaptable touch capabilities of Vulcan. Walmart recently sold its robotics systems business to Symbotic, indicating a pivot towards outsourcing instead of deep in-house innovation.

Global Retail Robotics Strategy: A Comparative Analysis of Amazon, Walmart, JD.com, Target, and Alibaba

Strategic Analysis

Amazon:

Every warehouse robot, AI system, and fulfillment tech ties into a centralized platform. Amazon's vertical integration in logistics and physical AI gives it the ability to outscale and outmaneuver on fulfillment cost and speed.

Walmart:

Focused on improving existing workflows with partners. Modular systems lower capex but lack long-term defensibility. Walmart is optimizing within a system Amazon is trying to replace.

Target:

Automation is in service of faster fulfillment, not scale. Emphasis is on store-based execution and short-range logistics. Strategic for its footprint, but limits long-term warehouse productivity.

JD.com:

Treats logistics as a proprietary asset. AI and robotics are native, not bolted on. JD is Amazon’s closest peer in robotics maturity, and a leader in warehouse tech in Asia.

Alibaba:

Logistics treated as a coordination problem. Less focus on warehouse robotics, more on optimizing national and cross-border movement. Cainiao is about orchestration, not manipulation.

Why Robots Help Amazon Win in Throughput and Cost Control

Amazon’s robotics stack enables:

1. Linear cost growth against exponential throughput:

More robots don’t require equivalent human supervision. This means Amazon can double fulfillment with less than double the cost.

Basis:

Amazon has deployed 750,000+ robots as of 2025 (Amazon Robotics).

Analysts from the Financial Times, Statista, and McKinsey have noted that automation improves throughput per square foot and per worker significantly faster than cost increases.

Estimated 25–30% throughput gains over 5 years vs. ~5–10% cost rise due to amortized capital expense and declining marginal cost of robots.

Assumption Used:

Robot-driven throughput follows an exponential curve due to compounding workflow optimization and 24/7 operation.

Costs rise linearly due to upfront capex and flat energy/maintenance overhead.

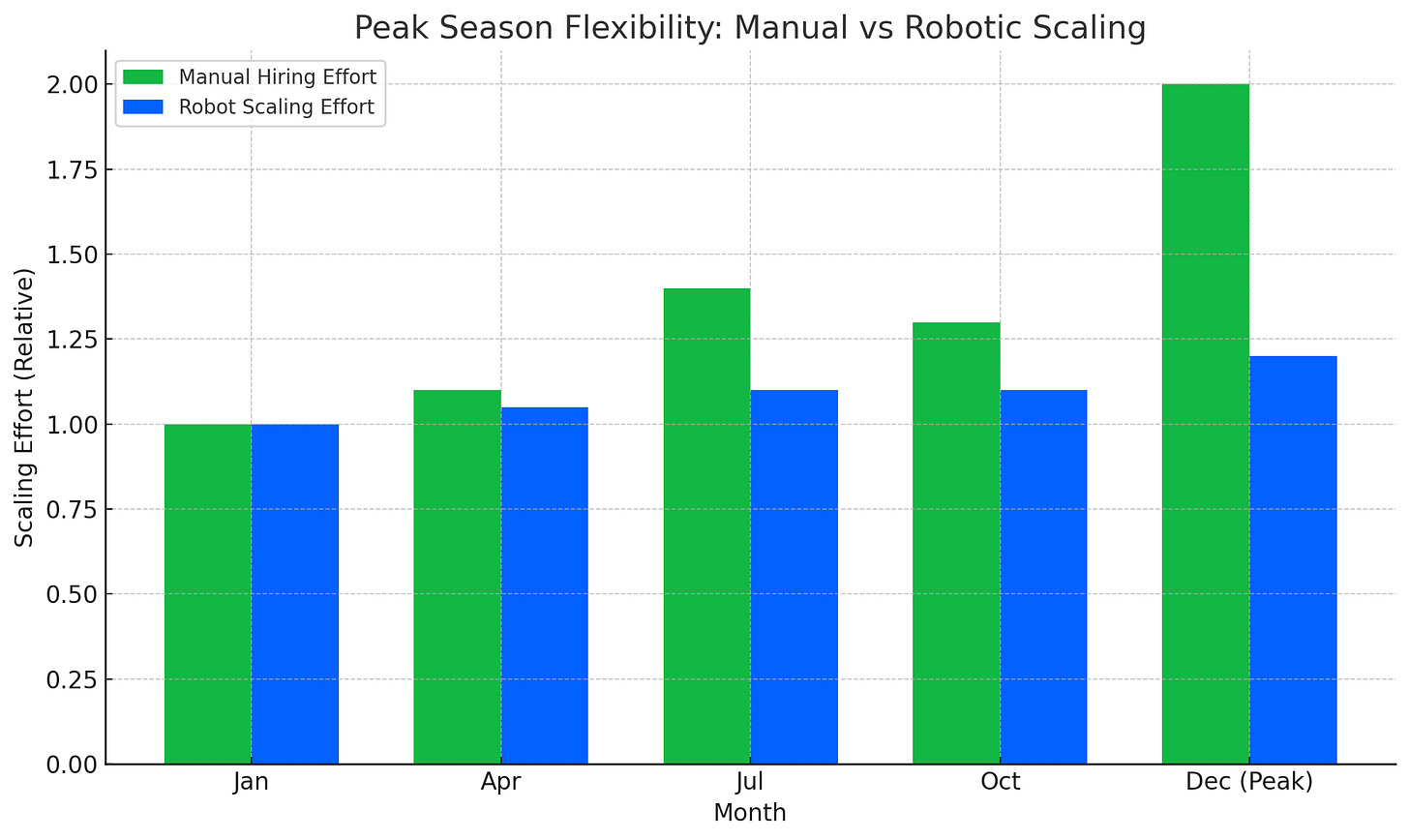

2. Peak season flexibility:

Robots don’t require training or hiring cycles. Amazon can instantly scale up or reconfigure workflows.

Basis:

Grocery Doppio, CBRE, and Retail Dive highlight that retailers like Amazon reduce seasonal hiring by up to 20–30% due to robotic assistance.

Robots don’t need onboarding, training, or labor contracts and can be scaled or redeployed instantly.

Assumption Used:

Manual labor requires 2× scale-up in December vs. ~20% increase in robotic load balancing.

Robot effort remains nearly flat through the year with slight tuning.

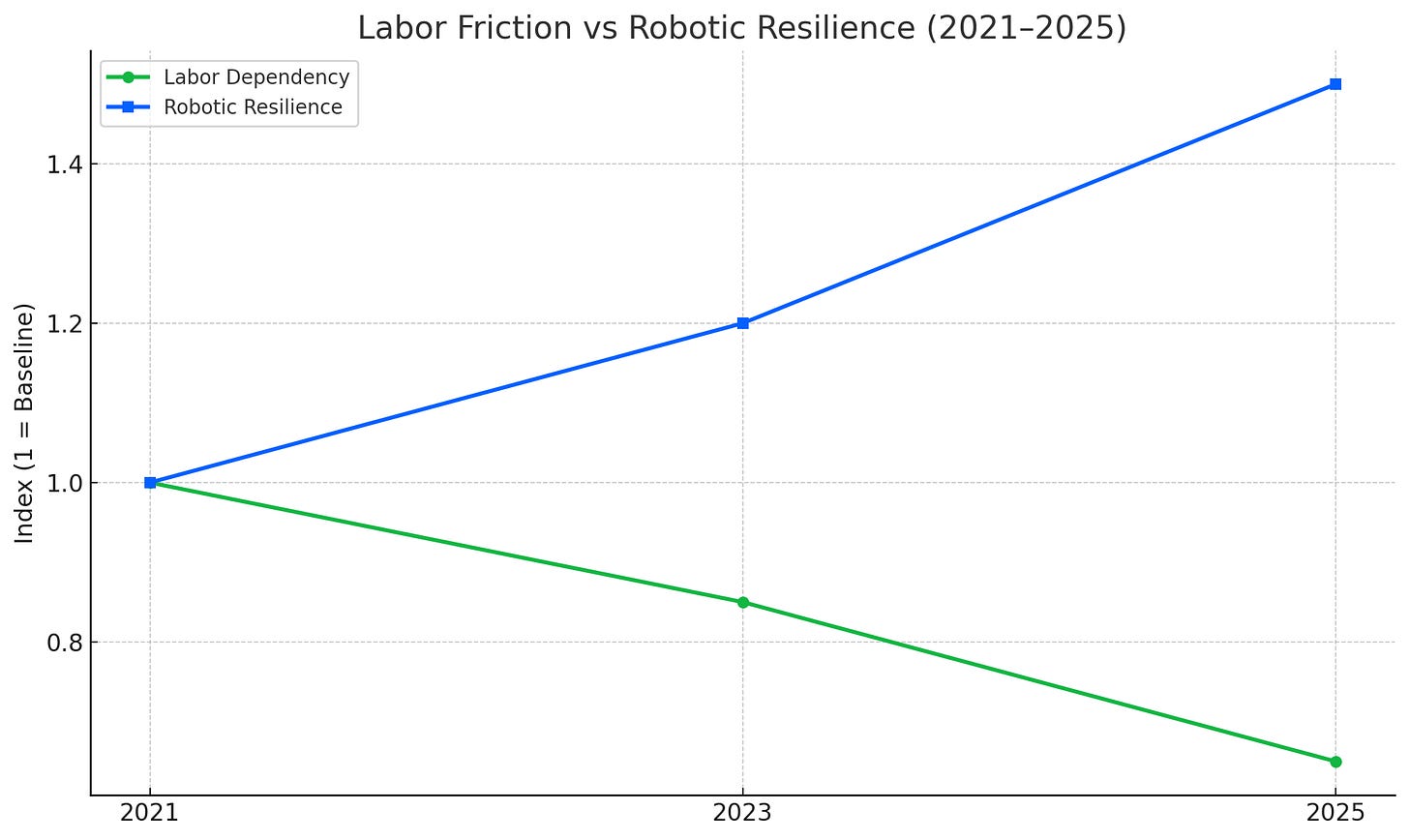

3. Lower labor friction:

As labor markets tighten, Amazon’s dependency declines. It becomes resilient to labor shortages, wage inflation, and unionization risk.

Basis:

Reports from Bain & Company, Morgan Stanley, and Business Insider project that:

Amazon could save $10 billion/year by automating 30–40% of fulfillment volume by 2030.

Labor-related friction (hiring, training, turnover, unionization risk) is materially reduced with automation.

Workplace injury data from Occupational Safety and Health Administration (OSHA) indicates ~30% injury rate drop with robot deployment.

Assumption Used:

Labor dependency index declines 15% every 2 years.

Robotic resilience increases in line with system learning and rollout.

Walmart, by contrast, still sees throughput gains limited by human capital. A Symbotic-powered warehouse still depends on manual workflows around it. Without full-stack automation, Walmart’s scalability will plateau.

Long term, Amazon’s cost per order will drop, while others may stagnate or rise. Throughput becomes a compounding advantage, not just a KPI.

What Comes Next

In the long arc of commerce, the companies that will lead are not merely the fastest or cheapest, but those that reimagine what fulfillment can be. Physical AI—embodied by Amazon’s Vulcan—is not just a technological upgrade; it’s a philosophical shift toward machines that can sense, adapt, and act with autonomy in the physical world. As robots evolve from task-specific tools to dynamic collaborators, warehouse strategy becomes the new strategic moat.

Organizations like Amazon and JD.com, who treat robotics as core infrastructure rather than modular add-ons, are building systems that scale exponentially while controlling cost, reducing friction, and delivering faster, more reliable customer outcomes.

In contrast, those that treat automation as a patch will find themselves limited by the very systems they optimize. The future of commerce belongs to those who can align intelligence, motion, and structure—turning warehouse floors into orchestrated engines of resilience and precision.

Robots are no longer just tools—they are co-workers. But to unleash their potential, warehouses must evolve. The question now: should you design robot-first warehouses, or can physical AI adapt to human-first layouts?