From Humanoids to AI Agents: How Autonomous Intelligence Is Transforming Supply Chain Logistics (AI in Supply Chain Use Case 3)

Most warehouse automation still relies on rigid, rule-based systems. This essay breaks down why the next leap won’t be more robots—it will be robots that think.

Hey, Nikhil here—welcome to The Silk Road Nexus. Twice a week, I unpack what’s shaping the world of supply chain—from deep dives on strategy and optimization to real stories from the frontlines of global commerce.

If this is your first read, you’re right on time to join a growing circle of operators, thinkers, and builders reimagining how the world moves.

“AI in Supply Chain Management” is an ongoing series where I explore not just current applications, but future opportunities for AI across the supply chain. Discover other use cases here.

The era of humanoid robots in warehouses is a transitional illusion. True competitive advantage will come from autonomous systems that learn, adapt, and act—without waiting for instructions.

That might sound bold, maybe even futuristic. But consider this: while most companies are still deploying semi-automated pick-and-pack robots to reduce labor friction, the next generation of logistics is already quietly forming. In it, robots won’t just be tools. They’ll be agents.

Despite record-breaking e-commerce growth (10–12% CAGR over the next decade), fulfillment costs are rising fast (and can represent 12%-20% of e-commerce revenue).

THE PROBLEM…

Speed remains the paramount concern for logistics leaders, as delivery expectations shorten and fulfillment networks stretch.

This is the core problem automation must solve—ensuring faster throughput, better responsiveness, and scalable reliability as demand accelerates. Fulfillment costs are rising fast.

Tariffs, labor shortages, and a more technologically complex product landscape (over 45% of consumer goods now embed chips) are stretching the limits of today’s warehousing systems.

Over 60% of publicly traded companies still treat logistics as a cost center, curbing investment in favor of cost containment—often at the expense of delivery speed and customer experience.

Amazon stands as a counterpoint. Its Vulcan robot, with tactile dexterity and human-level manipulation, is impressive. But it’s still reactive—waiting for commands, executing narrowly defined actions.

LEAP FROG SOLUTION…

The real leap comes next: robots that act independently, trained in simulated environments, guided by systems-level intelligence. This is the shift from task automation to Physical AI.

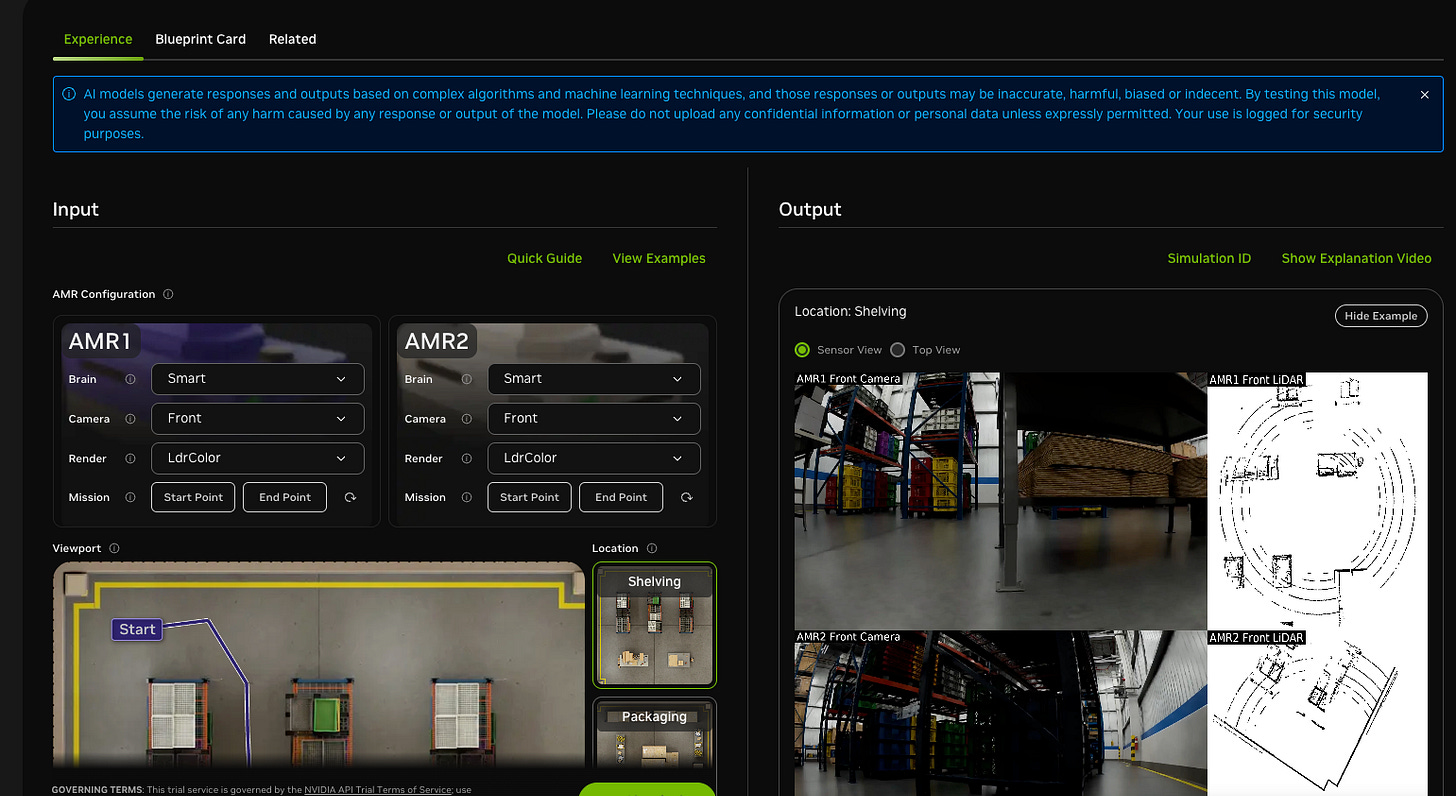

Earlier this year, NVIDIA, Accenture, and KION announced a partnership to bring NVIDIA’s Omniverse into warehouse automation. But the deeper story is about architecture, not software. What they signal is a modular framework to simulate, train, deploy, and coordinate intelligent agents inside real-world logistics networks.

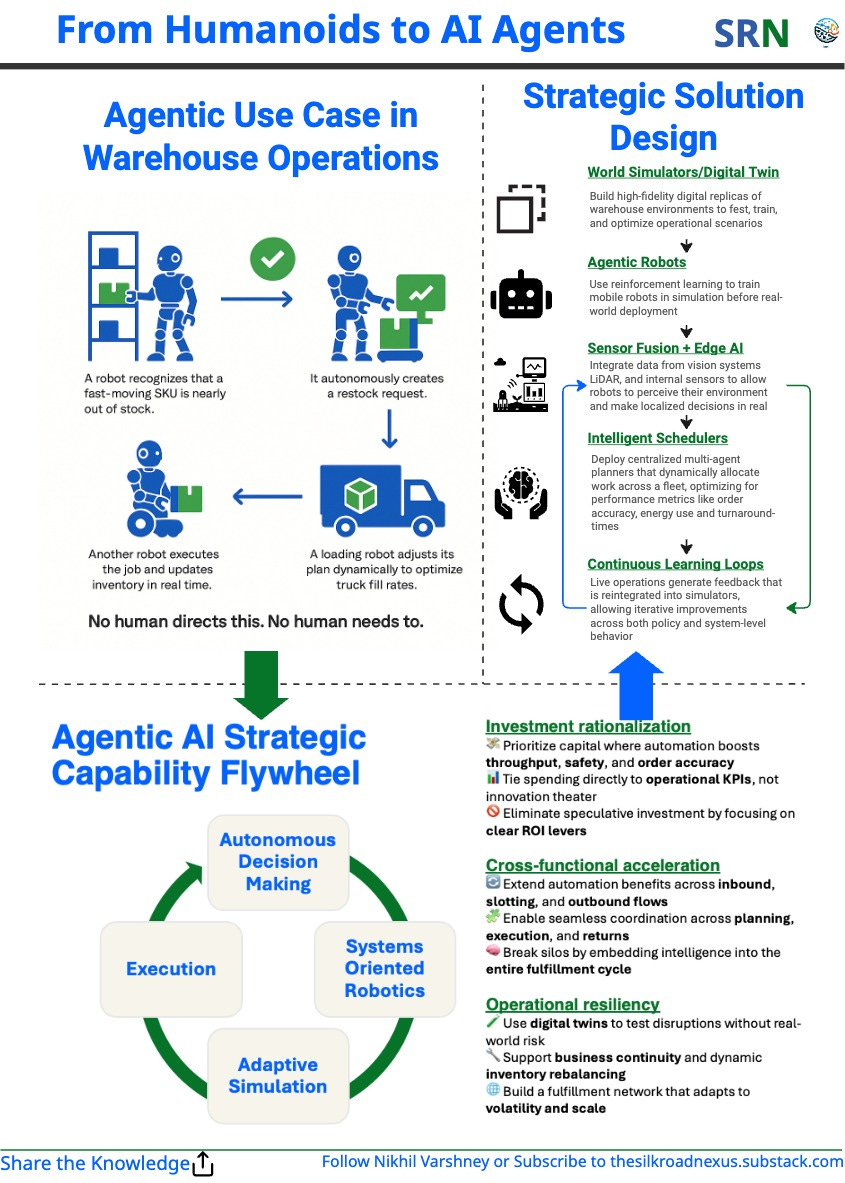

Here’s what that future looks like (a sample use case):

A robot recognizes that a fast-moving SKU is nearly out of stock.

It autonomously creates a restock request.

Another robot executes the job and updates inventory in real time.

A loading robot adjusts its plan dynamically to optimize truck fill rates.

No human directs this. No human needs to.

Warehouses evolve from deterministic scripts to self-optimizing, agentic systems. This isn’t automation. It’s autonomy.

Strategic Framework for Transitioning to Autonomous Logistics

To replace the traditional lens of competitive positioning (like Porter’s Five Forces), I present a strategic layout anchored in operational impact.

This framework is structured around a single axis of Value Chain Optimization, mapping out the progression from current-state semi-automation to fully autonomous, intelligent logistics infrastructure. Each value chain component—Inbound Logistics, Operations, Outbound Logistics, Quality Control, and Inventory Intelligence—is examined for how autonomy enhances throughput, accuracy, responsiveness, and system-wide learning.

Rather than isolate automation by technology type, I view this evolution as an enterprise capability arc:

Manual Execution ➝ Task Automation ➝ Systems-Oriented Robotics ➝ Adaptive Simulation ➝ Autonomous Decision-Making

This structured path represents more than a maturity curve—it is a strategic capability flywheel. Each step enhances decision latency, resource productivity, and the margin leverage of logistics operations.

Investment rationalization: Capital is deployed where automation has the clearest impact on throughput, workforce safety, and order accuracy. I avoid speculative spending by tying investments directly to operational KPIs.

Cross-functional acceleration: As capabilities evolve, benefits cascade across touchpoints—from inbound efficiency and slotting accuracy to outbound capacity planning and reverse logistics.

Operational resiliency: Adaptive simulation and digital twins build shock-absorption into fulfillment workflows, allowing organizations to test business continuity and inventory rebalancing without operational disruption.

System intelligence: Autonomous decision-making transforms warehousing from a rule-based engine to a probabilistic, learning-based ecosystem that improves with each task cycle.

Ultimately, this isn’t just about automation—it’s about compounding strategic advantage. Organizations that treat autonomy as a core infrastructure capability, not a bolt-on feature, will redefine what best-in-class logistics means over the next decade.

The result is not a framework of phases, but a continuum of compounding capability—where value accrues at each stage and builds the foundation for autonomous, intelligent commerce.

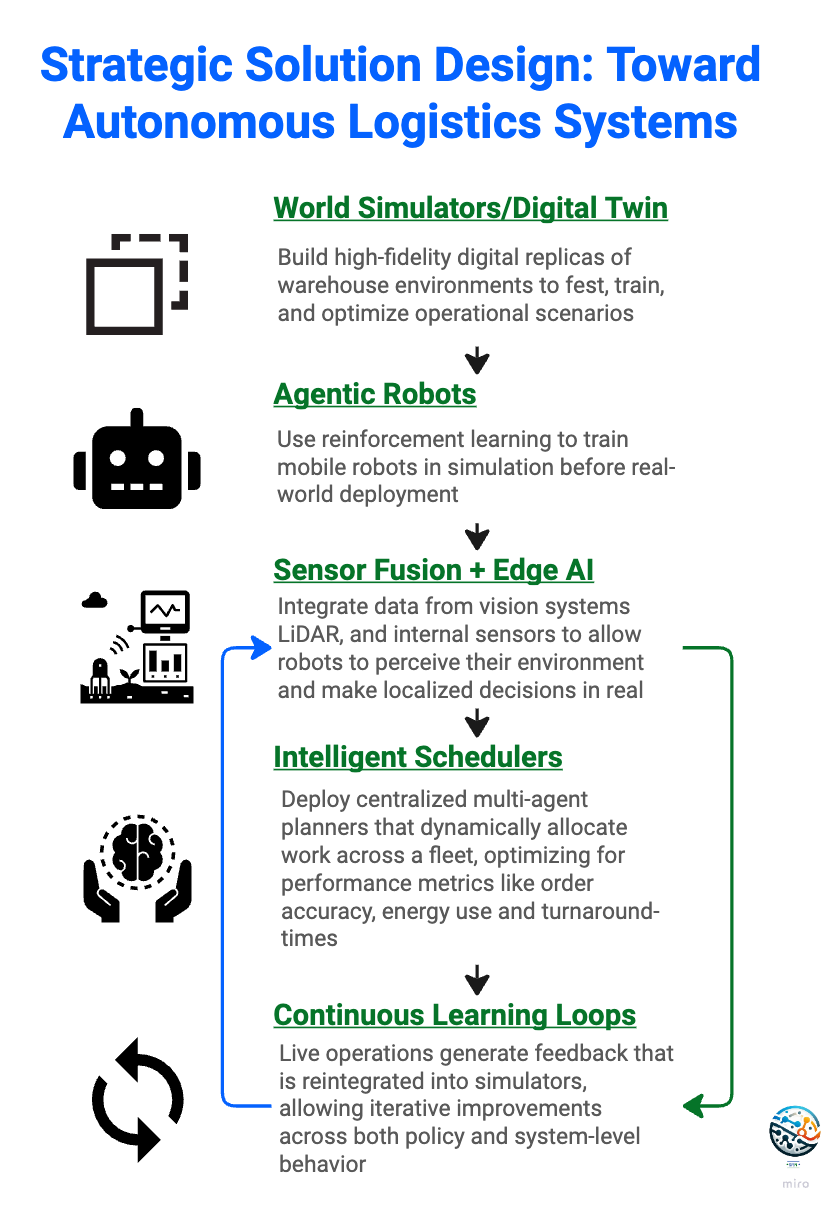

Strategic Solution Design: Toward Autonomous Logistics Systems

To transition, firms must deploy five interlocking components:

World Simulators / Digital Twins: Build high-fidelity digital replicas of warehouse environments to test, train, and optimize operational scenarios. Digital twins offer a powerful mechanism to "sense the future"—they simulate disruptions, test interventions, and forecast outcomes without interrupting live operations. This enables cost savings through reduced downtime, improved layout design, predictive throughput modeling, and intelligent exception handling.

Agentic Robots: Use reinforcement learning to train mobile robots in simulation before real-world deployment. Robots learn how to pick, place, reroute, and collaborate across dynamic environments.

Sensor Fusion + Edge AI: Integrate data from vision systems, LiDAR, and internal sensors to allow robots to perceive their environment and make localized decisions in real time.

Intelligent Schedulers: Deploy centralized multi-agent planners that dynamically allocate work across a fleet, optimizing for performance metrics like order accuracy, energy use, and turnaround times.

Continuous Learning Loops: Live operations generate feedback that is reintegrated into simulators, allowing iterative improvements across both policy and system-level behavior.

This architecture turns a warehouse into an adaptive system: sensing, reasoning, and reacting in real time across unpredictable conditions.

Even complex tasks like quality control can be automated. Non-invasive scanning and AI-driven defect detection eliminate the need to unbox fragile items, significantly reducing error rates in high-value goods like vanities.

CHALLENGES AS HIGHLIGHTED…

The common refrain is that this vision is too fragmented to scale. That each warehouse is too unique. That intelligence can’t be standardized. I disagree.

With a modular architecture that decouples intelligence from hardware and places learning at the system level, we can train robots not just to move goods, but to manage the warehouse itself.

Humanoid robots are a stopgap. They reduce friction today, but they still rely on human-coded logic. The real transformation is autonomy. Not robots doing what they’re told—robots figuring out what to do.

That is the future of Physical AI. And that is the next great leap in logistics.

This shift should give rise to a new generation of third-party logistics (3PL) providers—ones that don’t just offer capacity, but deliver Warehouse-as-a-Service through Robotics-as-a-Service.

These 3PLs will build and operate autonomous, AI-powered warehouses, offering cutting-edge fulfillment infrastructure to retailers and manufacturers who are risk-averse or lack the capital to invest in full-scale physical AI systems.

According to Armstrong & Associates, the global 3PL market has grown from $750 billion in 2017 to over $1.4 trillion in 2023, driven largely by ecommerce and rising complexity in global fulfillment. This market is projected to grow at 8–10% annually, and warehouse-as-a-service models are expected to become one of its fastest growing segments. The cost-efficiency, speed, and flexibility enabled by autonomous robotics will be productized and sold as infrastructure to companies that would otherwise fall behind.

In this way, the future of autonomous logistics is not only about internal transformation—it’s about creating a platform layer that reshapes who gets to compete in modern commerce.

DOWNLOAD THIS INFOGRAPHIC

DOWNLOAD AS A PDF… Click below

👀 Still here? That means you liked it. Hit subscribe so you don’t miss the next brain snack—and go ahead, send it to that one friend who really needs this more than they know.