AI Use Case 4 in Supply Chain: Probabilistic Inventory Optimization to Unlock Trapped Capital

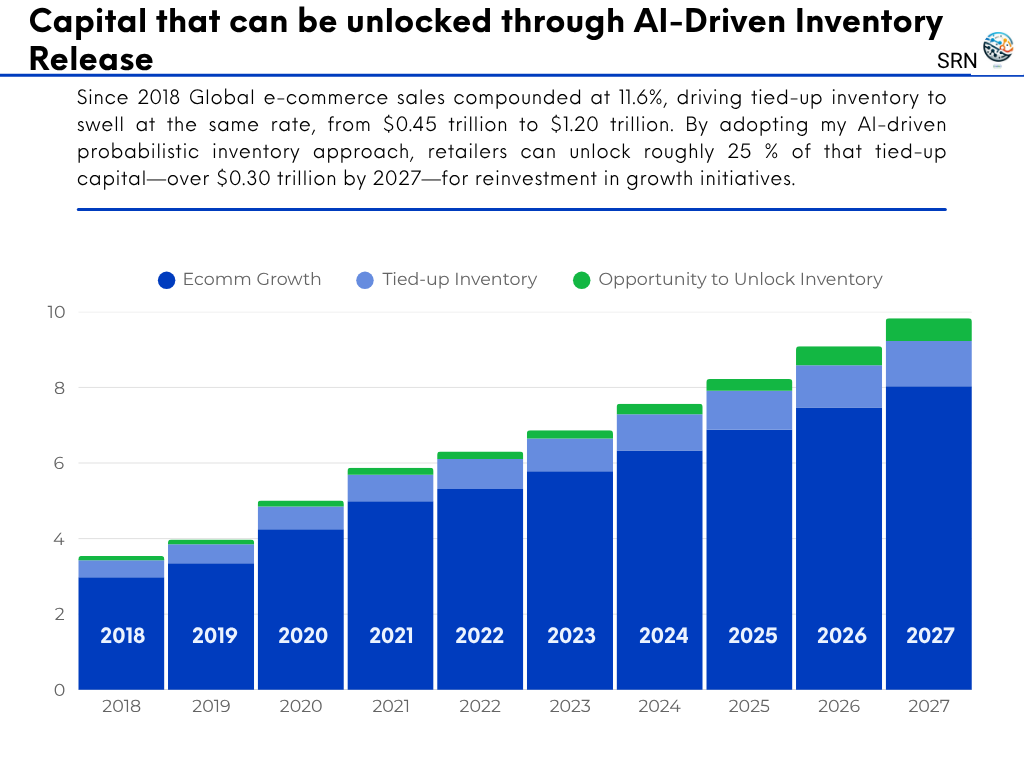

Leveraging AI-driven forecasting and reinforcement learning, this approach frees up 25 % of tied-up inventory, boosts service levels, and supports e-commerce growth from $2.9 T to $8.0 T (2018–2027)

Hey, Nikhil here—welcome to The Silk Road Nexus. Twice a week, I unpack what’s shaping the world of supply chain—from deep dives on strategy and optimization to real stories from the frontlines of global commerce.

If this is your first read, you’re right on time to join a growing circle of operators, thinkers, and builders reimagining how the world moves.

“AI in Supply Chain Management” is an ongoing series where I explore not just current applications, but future opportunities for AI across the supply chain. Discover other use cases here.

Over the past five years global e-commerce sales have leapt from $2.8 trillion in 2018 to over $6.3 trillion in 2023, compounding at nearly 18 percent, and are on track to exceed $8 trillion by 2027. Yet retailers still bleed trillions each year to inventory missteps:

$1 trillion tied up in excess stock sitting idle across DCs and backrooms (roughly 15 percent of total inventory value)

4 percent of online orders lost to stock-outs—translating into over $250 billion in forgone revenue annually

25 percent of all working capital consumed by safety-stock buffers meant to “cover” forecast errors

These losses stem from deterministic inventory models that hinge on a single “expected” demand estimate.

PROBLEM: When demand spikes 30 percent above forecast, now commonplace during flash sales, social-media-driven trends, or sudden tariff shifts, those rigid models either under-stock and miss sales or overstock and erode margins.

In a world where consumer behavior can swing double-digit percentages week to week, clinging to point forecasts is like fixing your navigation to yesterday’s map: it can’t guide you through today’s uncertainties.

I propose that this mismatch between rigid forecasting and volatile reality represents the biggest hidden tax on today’s supply chains, and that probabilistic AI methods offer the strategic leap required to break free.

In this essay I unpack why static formulas fail in a world of shifting consumer trends, tariff shocks, and competitive seller behavior.

I then sketch a visionary AI-powered framework that positions inventory dynamically, turning stores and forward stocking locations into proactive fulfillment centers rather than passive showrooms.

Along the way I highlight where I’ve contributed fresh thinking and how you can apply these insights to build a true competitive moat.

The Trap of Deterministic Thinking, the Power of Probability

Traditional models assume demand is known, lead times are fixed, and competitors are mute observers. In reality demand behaves like a high-variance signal [source 2], supply chains endure random disruptions from geopolitical events, and every seller’s move ripples through the network.

I argue that relying on point forecasts is equivalent to driving blindfolded through a storm, hoping the road remains straight.

By reframing demand as a probability distribution, I introduce strategic optionality, you can:

Hedge against tail-risk spikes in demand,

Allocate safety stock where it matters most, and

Avoid tying up capital in low-velocity items.

This shift transforms inventory from a static liability into a dynamic asset that shifts with market tides.

For example, Amazon’s Forecast CNN-QR model now outputs full demand distributions by training neural networks to minimize quantile loss . One fresh-produce supplier saw accuracy jump from 24 percent to 76 percent, waste fall by 30 percent, and in-stock rates climb from 80 percent to 90 percent using Amazon Forecast.

From Passive Stockrooms to Active Fulfillment Hubs

Forward positioning is more than a cost lever, it is a strategic axis of competition.

In my previous essay [and another] , I had proposed that retailers treat each store and regional hub as an intelligent node in a self-optimizing network.

Instead of siloing safety stock in obscure backrooms, each location learns from probabilistic forecasts which items to pre-position based on local demand signals, promotional calendars, and competitor behavior.

This creates a virtuous cycle of faster delivery, stronger conversion, and heightened customer loyalty, reinforcing the retailer’s brand promise as a key differentiator.

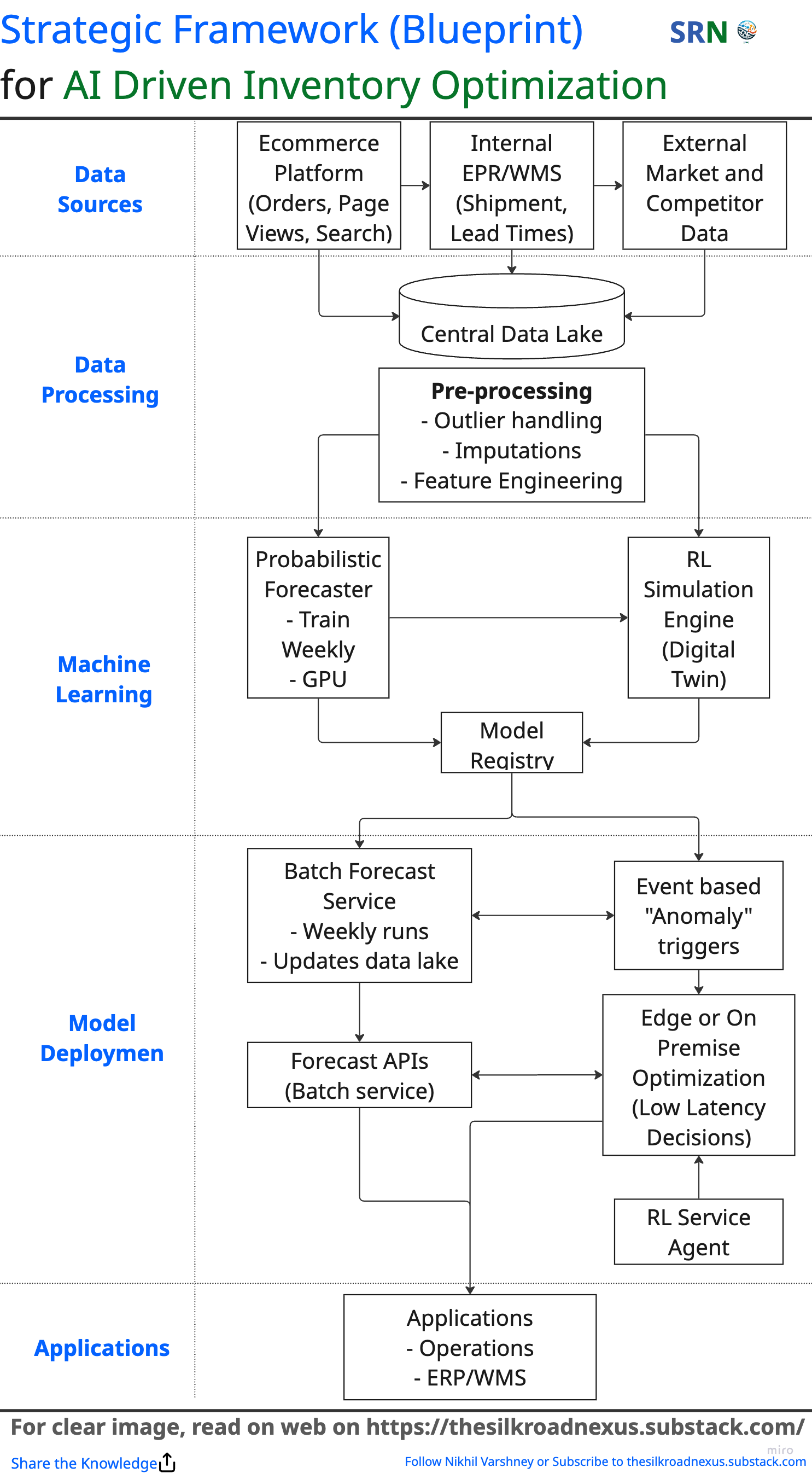

Strategic Blueprint (Framework) for AI-Driven Inventory Optimization

Rather than deep diving into every algorithmic detail, I focus on the strategic architecture, which combines the best of these leading practices with my enhancements:

Probabilistic Forecasting generates confidence intervals for demand at each node, enabling risk-adjusted stocking decisions.

Reinforcement Learning (RL) acts as an autonomous planner, setting inventory allocation policies that maximize long-term reward under uncertainty and learning from real-world feedback loops.

Hybrid Deployment spans cloud for heavy training, on-premise for data sovereignty, and edge compute at high-volume hubs for real-time decisioning, ensuring agility without compromising performance.

1. Define a Unified Data Backbone

First, break down silos by unifying demand, supply and external signals into a single source of truth. As a product leader, you align stakeholders, business, procurement, warehouse, finance, around a shared data strategy.

This creates a reliable foundation for all AI capabilities, ensures cross-functional visibility and builds confidence in model outputs.

2. Embed AI-Powered Decisioning as a Core Capability

Next, elevate forecasting and allocation from “nice-to-have” tools to a strategic advantage. I recommend a two-phase rollout:

Phase one, deploy probabilistic demand forecasts to surface the likelihood of demand spikes or drops. Provide planners with confidence bands instead of single numbers, enabling risk-adjusted stocking decisions.

Phase two, introduce a reinforcement-learning-driven allocation engine that learns optimal stock placements over time, balancing service levels, holding costs and competitive dynamics. Framing these as iterative product releases lets you capture quick wins while maturing AI sophistication.

3. Leverage Hybrid Infrastructure for Agility and Control

To meet both scale and security needs, I advocate a hybrid deployment strategy. Host heavy training workloads in the cloud for elastic GPU compute, keep sensitive master data on-premise, and run lightweight inference at high-volume hubs for real-time fulfillment decisions. This approach reduces latency, contains costs and gives operations teams confidence that critical data never leaves the enterprise perimeter.

4. Integrate Seamlessly into Operational Workflows

AI insights must translate into action. Embed model outputs into your existing “control tower” or operations dashboard, surfacing key recommendations, like replenishment triggers or regional rebalancing plans, directly where planners work. Ensure two-way integration: model suggestions generate system orders in the WMS or ERP, and execution results feed back into the AI for continuous learning.

5. Establish Governance, Metrics and Continuous Improvement

Finally, treat this as a living product, not a one-off project. Define clear KPIs,

forecast error,

fill rate,

inventory turns,

cost per order

Set up executive-level dashboards for regular reviews.

Implement human-in-the-loop checkpoints for high-impact or anomalous recommendations, building trust while capturing vital qualitative feedback.

Schedule regular model retraining cycles tied to performance thresholds, so the system stays aligned with evolving market dynamics.

Overall, this modular, hybrid blueprint ensures:

Fresh, unified data powering AI

Scalable training in the cloud with on-prem privacy

Flexible inference (batch + real-time + edge)

Cost optimization via tiered deployments

Tight operational integration with human oversight

By following this strategic flow, unified data, phased AI capability, hybrid infrastructure, operational integration and rigorous governance, you transform inventory from a static cost center into a dynamic, competitive lever that adapts in real time to customer demand and market shifts.

Operationalizing the Intelligent Inventory System

Strategic AI is not a black box, and success depends on rigorous monitoring and governance. I advocate a

Human-in-the-loop approach where planners review high-impact recommendations flagged by the system, ensuring that edge cases and one-off events receive expert judgment.

Continuous retraining and KPI tracking, on metrics like fill rate, inventory turnover, and forecast calibration, keep the engine tuned.

Over time, as trust grows, the model can assume increasing autonomy, letting your team focus on higher-order strategy rather than tactical firefighting.

Conclusion: Turning Inventory into Strategic Advantage

In competitive marketplaces, inventory is no longer a backend cost center but a front-line weapon of differentiation.

By embracing probabilistic AI and visionary deployment across cloud, on-premise, and edge, retailers can transcend the limitations of deterministic thinking.

I have outlined how to transform passive stockrooms into active, intelligent hubs that anticipate demand, outmaneuver competitors, and deliver a superior customer experience.

The future of supply chain is not about predicting a single outcome, it is about mastering the art of uncertainty, and in that domain, AI is your most powerful ally.

Thanks, good stuff. What are your thoughts on making RL work robustly in this context?