How to Build a Smarter Inventory Network Using Optimization and Game Theory — Part II: Forward Inventory Positioning

From Optimization Models to Seller Strategy — A Deep Dive into Inventory Placement That Actually Works. A Leadership Playbook for Balancing Speed, Cost, and Competitive Dynamics.

Retail networks are standing at a crossroads. 🚦

WARNING: (If you are looking for a two-minute read, this is not it. Real optimization, competitive modeling, and ecosystem thinking deserve more than a skim. 📚)

In Part 1, “Forward Inventory Positioning: The Ultimate Guide to Faster Delivery, Lower Costs, and Supply Chain Resilience”, I explained why forward positioning is a growth lever and why should companies adopt it. 📈

In this article, I introduce two practical models,

1. Optimization Model to decide how inventory should be placed, and

2. Game Theory Model to understand how sellers behave once forward positioning becomes a competitive lever.

📥 Want the downloadable inventory planning framework?

Subscribe for free and I’ll send you the full template — no paywalls, no spam, just practical tools to level up your supply chain strategy.

The traditional model, stocking massive backrooms to maximize in-store service, worked in a predictable, brick-and-mortar world. But today, the game has changed. 🎲

Omnichannel demand is unpredictable, shipping costs are volatile, and global disruptions are rewriting the supply chain playbook almost monthly. 🌎🚢

Tariffs between the United States and China, retaliatory trade measures across Europe and Asia, rising tensions in the Red Sea, and ongoing geopolitical conflicts are forcing companies to rethink not just where products are made, but how they are moved, stored, and fulfilled. ⚔️📦

The old model of centralized warehouses feeding endless last-mile deliveries no longer makes economic sense. ❌🚛

Retailers are starting to realize,

🛍️ Stores cannot just be showrooms anymore,

🏢 Backrooms cannot just be safety stock vaults,

✅ They must become active fulfillment hubs.

Using local stores and Forward Stocking Locations (FSLs) to fulfill online orders is becoming a critical strategic lever, particularly for fast-moving and high-demand inventory. 🚀📦

However, forward positioning is not universally applicable. For long lead time or slow-moving items, centralized fulfillment may still offer better economics. 🏗️

Retailers must carefully assess inventory profiles, customer expectations, and operational constraints to determine where forward positioning delivers the greatest advantage, particularly in a world shaped by geopolitical risks, rising tariffs, and supply chain volatility. 🌐⚡

In this article, I build a mathematical model to show how forward inventory positioning, strategically placing products closer to demand, can drive speed, cost efficiency, and resilience. 🧩🚀

The Model

In this article, I propose two complementary models to address forward inventory positioning in today’s volatile environment:

📈 The Optimization Model, which helps retailers and platform operators decide where, when, and how much inventory to forward-position to minimize total cost while improving service levels.

🎲 The Game Theory Model, which captures the competitive behavior of sellers once forward positioning becomes an option, showing how individual choices affect the broader ecosystem.

Both models are necessary because optimizing inventory placement alone does not guarantee competitive success. In multi-seller environments, sellers react to each other’s moves, and platforms must anticipate these strategic interactions to manage capacity, pricing, and service outcomes effectively.

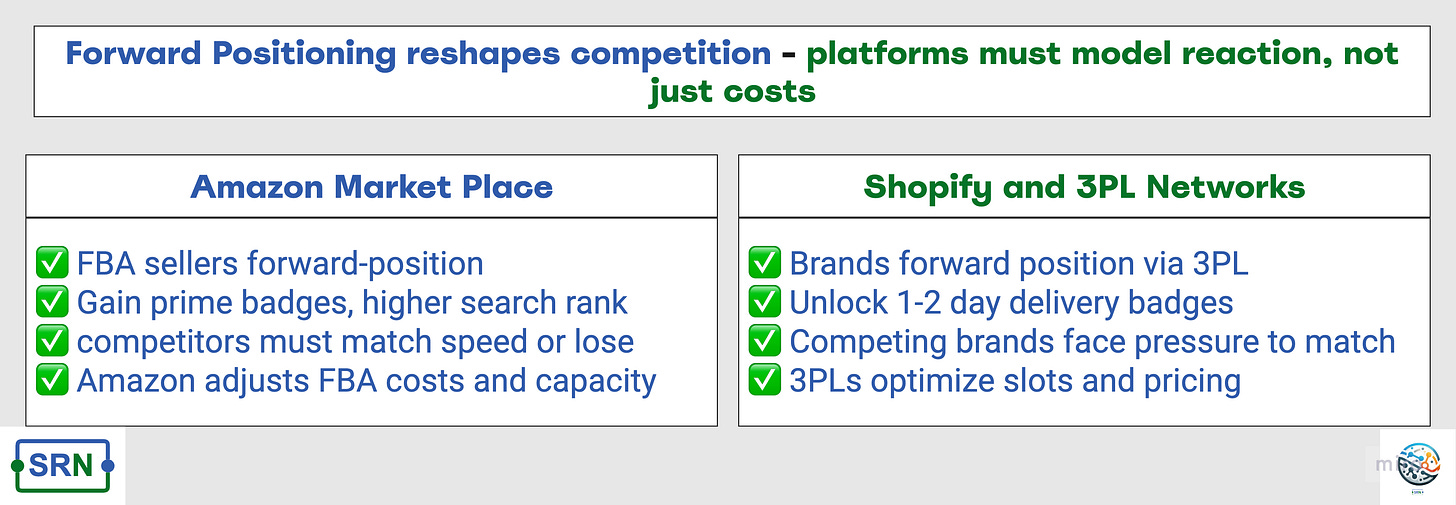

🌍 Real World Spotlight: How Forward Positioning Forces Competitive Shifts

🔵 Amazon Marketplace:

On Amazon, sellers who forward-position inventory through FBA gain faster shipping badges, higher search rankings, and greater Buy Box dominance. Competing sellers must either match by moving inventory closer (at higher costs) or risk losing market share. Amazon, in turn, must constantly adjust FBA pricing, warehouse access, and fulfillment promises to manage capacity and seller behavior.

🟢 Shopify and 3PL Networks:

On Shopify, brands that forward-position inventory through regional 3PLs unlock faster delivery badges (“Ships in 1-2 Days”), boosting conversion rates and customer loyalty. As more brands compete for premium 3PL space, fulfillment providers must prioritize inventory slots, raise prices, and restructure their service tiers. Forward positioning by early movers reshapes the competitive landscape for everyone.

Together, the models provide a complete, system-level view that bridges operational efficiency and market dynamics. 🌐

If you are a retailer, seller, carrier, or platform operator, you face one central question:

❓ How do I decide where, when, and how much inventory to forward-position, without breaking the bank?

On the surface, it feels simple: stock closer to customers, faster shipping. 🚀

But dig deeper, and you realize:

🏢 Space is limited

📦 Inventory has hidden costs (storage, handling, markdowns)

🔁 Returns flood warehouses

🏠 Real estate is expensive

🎯 Customers are unpredictable

🤼 Sellers compete aggressively inside the platform

It is a system of interconnected decisions. 🔗

Modeling helps bring structure to this chaos.

It makes invisible trade-offs visible. It helps answer:

“Where should I place inventory? How much? And what will happen next?”

And do not worry, I will keep the math simple enough to follow, but deep enough to respect the real-world complexity. 📚✏️

One of the most quibbling and complicated things during modeling is that variables come in different dimensions — some are in units, others in dollars, percentages, or time.

Here, I will also show you how to convert all variables into a single denomination like dollar value 💵 to enable running and creating effective optimization models.

The First Layer: Forward Positioning Inventory Optimization Model (The Retailer’s View)

The retailer, or platform operator, first faces an optimization problem that juggles multiple priorities.

The goal is simple to say but tough to deliver:

Serve customer demand efficiently 🛍️, minimize total supply chain costs 💰, maximize the customer experience 🌟, and at the same time support the broader ecosystem of sellers 🤝.

In tackling this, the costs stack up quickly. There are:

📦 Holding costs (inventory sitting in warehouses)

🚚 Transportation costs (moving inventory in and out)

❌ Stockout penalties (lost sales)

🔁 Returns processing

🏢 Real estate occupancy costs

⏳ Opportunity cost of excess inventory

However, it is not all doom and gloom. Forward positioning also brings tangible benefits:

🚛 Local carrier flexibility → reduced shipping costs

I build an equation that balances all of these forces — and crucially, translates them into dollar values 💵 so that every trade-off is clear and quantifiable.

Without getting lost in equations yet, the basic idea is:

Minimize net supply chain cost (costs minus benefits), while meeting service level targets. 🎯

Minimize: (H + T + R + RE + O) - (B)

Where:

H = Holding costs 💰

T = Transportation costs 🚚

R = Returns processing costs 🔁

RE = Real estate occupancy costs 🏢

O = Opportunity cost of excess inventory ⏳

B = Benefits (like faster delivery, higher conversion rates, lower last-mile costs) 🚀

📐 Mathematically speaking, here’s the core equation that powers everything we’ve discussed so far.

Even if equations aren’t your thing, I promise this one is worth your attention — it’s what turns forward positioning from a gut call into a measurable, testable strategy. (Skip it, and you might miss the real competitive unlock.) 😉

🔎 Note: For the best viewing experience, especially for the full equation, please open this post on a desktop browser. Mobile apps and email previews may not render the formatting correctly.

This equation is the intellectual property of Silk Road Nexus and is protected by copyright

Retailers can use this optimization model to:

🏬 Decide which warehouses should become FSLs

📦 Determine how much inventory to place where

📊 Predict costs, service levels, and returns

🎲 Second Layer: The Game Theory Model (The Seller’s View)

This is where the strategic calculus begins. 🧠

In any large marketplace, such as Amazon or Walmart, multiple sellers operate on the same platform. Some have the financial and operational ability to forward-position their inventory closer to the customer 📦➡️🏠. Others may choose to centralize inventory to save on costs 🏢💰. The introduction of Forward Stocking Locations (FSLs) creates a new competitive axis — and how each seller responds to it shifts the dynamics for everyone. 🔄

Game theory helps us frame this as a series of interdependent decisions. 🎯

Each seller faces two core strategies:

🚀 Forward Position: This incurs higher operational cost, but increases delivery speed and improves customer visibility.

🏢 Centralize: This reduces holding and transportation costs, but may lead to delayed delivery and lost conversions.

If only a few sellers adopt forward positioning, they are likely to gain disproportionate visibility and sales due to faster fulfillment and better ranking on the platform. 📈

If everyone forward-positions, the advantage disappears, and capacity becomes constrained, leading to increased inbound complexity and potential cost escalation. 🔁📊

Conversely, if no seller forward-positions, the platform as a whole may suffer slower delivery and lower customer satisfaction. 🐌📉

This competitive dynamic creates a Game with the following outcomes: 🎮

Result: Forward Positioning becomes the dominant strategy if the gains outweigh the costs.

🔁 Third Layer: System Interaction (Platform and Carriers)

As sellers shift toward forward positioning, the entire commerce ecosystem must recalibrate. 🧭

Platforms face immediate pressure to manage limited warehouse real estate, dynamically allocate Forward Stocking Location (FSL) access, and maintain a competitive seller environment. Some may introduce quota systems, tiered access models, or dynamic pricing based on demand intensity 📈.

Carriers simultaneously benefit from this shift. More localized shipments Reduce reliance on:

Expensive long-haul routes 🚛,

Enabling denser and more predictable delivery networks 🗺️.

Customers experience:

Faster shipping ⚡,

Improved service reliability ✅, and

Higher satisfaction 😊

All of which strengthen platform loyalty 🤝.

However, when forward-positioning space becomes constrained, platforms must strategically intervene.

They may need to prioritize:

Which sellers can forward-position based on performance metrics 📊,

Expand fulfillment infrastructure 🏗️, or

Design dynamic inventory rebalancing programs to prevent localized bottlenecks 🔄.

The interaction between seller strategies, platform policies, carrier operations, and customer expectations creates a dynamic feedback loop 🔃. Left unmanaged, this loop risks cascading inefficiencies 🚨. Winning platforms will not merely react to these changes — they will model, anticipate, and actively orchestrate system-wide behaviors to sustain forward-positioning advantages at scale 🎯.

As sellers shift to forward positioning:

🏢 Platforms must manage limited warehouse real estate

🎯 Platforms may set quotas or dynamic pricing for FSL access

🚚 Carriers benefit: more localized shipments, lower linehaul dependency

😊 Customers benefit: faster shipping, better experience

However, if space runs out, platforms must:

🥇 Prioritize which sellers get to forward-position

🏗️ Expand fulfillment capacity

🔄 Encourage dynamic rebalancing of inventory

This ecosystem feedback loop is complex 🔁 — and needs system-level modeling to stay balanced ⚖️.

Think of this as your backstage pass to the inventory drama — who does what, who wins what, and who needs to hustle harder. The ecosystem isn’t just moving boxes; it’s a layered game of margins, speed, and survival.

Conclusion: Winning the Future of Supply Chain 🌍

Forward positioning of inventory is not just a tactical move anymore. It is becoming a strategic ecosystem play involving retailers, sellers, carriers, and platforms.

Those who think systemically — not just about their own costs, but about seller behavior, warehouse constraints, customer loyalty, and carrier dynamics — will win.

In today's world, supply chains are marketplaces, and marketplaces are supply chains.

Inventory is no longer just about fulfillment. It is about competitive survival.

References:

Forward Positioning and Consolidation of Strategic Inventories

Analyzes forward consolidation using optimization models in military logistics, with strong implications for commercial inventory strategies.

Supply Chain Resilience: A Review from the Inventory Management Perspective

A comprehensive literature review focusing on how inventory strategy, including forward positioning, enhances resilience.

Strategic Inventory Placement in Supply Chains – MIT Sloan

A seminal working paper discussing optimization under non-stationary demand and its relevance to forward positioning.

INVALS: An Efficient Forward Looking Inventory Allocation System

Introduces an inventory allocation model that anticipates demand and optimizes labor and capacity.

Stochastic Optimization of Inventory at Large-Scale Supply Chains

Discusses stochastic and scalable methods to manage inventory and placement across complex networks.

The Counterintuitive Truth About Inventory Optimization – ToolsGroup

Discusses why inventory optimization is more than just reducing stock—it’s about increasing availability.

Supply Chain Inventory Optimization – GEP

Outlines actionable ways to optimize inventory while controlling costs and improving agility.

How AI Can Improve Inventory Optimization – Clarkston Consulting

Covers how AI and data analytics can help predict demand and support decisions on forward inventory placement.

Top Supply Chain Analytics Blogs of 2024 – Arkieva

A roundup of the most insightful blogs on supply chain analytics, demand planning, and inventory positioning.

Inventory Optimization in a Turbulent Economy – LMA Consulting Group

Offers practical guidance for optimizing inventory under economic uncertainty, including real-world scenarios.