Takes & Tickers – June 12, 2025 [Edition 4]: TikTok Shop Conference, Manila 2025: How TikTok Secured a Platform Advantage Over Amazon and Meta

ACE 2.0 and PACE fuel TikTok’s emotional commerce play—built for Gen Z, beyond search, and ahead of Amazon and Meta in personalization. Also, how shift in emotional needs change in buying practices.

Welcome to the fourth edition of Takes & Tickers — a weekly lens on the most strategic moves shaping the global supply chain.

This Thursday, I break down how TikTok’s ACE 2.0 is reshaping the future of e-commerce.

👉 Emotional engagement converts instantly. Amazon is retrofitting. Meta is stitching. TikTok is already there.

👉 I explore why TikTok wins the first click and Amazon still owns the second, and what this means for the future of commerce built on discovery, not just delivery.

Your Voice Matters!

Help me tailor content that truly fits your needs and skills by taking our quick survey. It takes less than 1 minute — and makes a big difference.

Please take the survey now, click here

1. How TikTok Rebuilt the Commerce Stack

TikTok Shop’s rollout of ACE 2.0 creates a strategic inflection point.

The platform is leaning into a fast-growing market and using structural advantages to challenge Amazon’s dominance in e-commerce.

1.1 People don't shop in steps. They shop in moments.

TikTok sees that. It built PACE: Persona, Assortment, Content, Empowerment, to move with emotion, not intention.

Originally launched as ACE, TikTok added Persona to anchor its system in real-time behavioral segmentation. This turns micro-signals into instant execution: who the user is, what they want, when they’re ready.

PACE is the interface.

Persona: This is the lens that grounds every interaction in real-time segmentation. TikTok identifies not just who the user is (e.g., Gen Z Student, Budget Hunter), but when they're in that mindset. This makes personalization dynamic, not static. Unlike Meta’s demographic targeting or Amazon’s browsing history, TikTok adapts to emotional context in the moment.

Assortment: TikTok doesn’t leave catalog decisions to chance. It uses behavioral signals to guide SKU bundling, sequencing, and price framing. Amazon requires sellers to optimize on their own or use external tools. TikTok bakes that intelligence into the interface, directly increasing AOV without plugins.

Content: The format is the strategy. TikTok treats short-form video as a commerce lever, not just a media format. Sellers receive real-time prompts on scripts, hooks, timing, and even thumbnail positioning—all informed by user behavior. Meta offers creative tools, but they are post-hoc. TikTok turns creativity into a feedback loop.

Empowerment: Where most platforms give sellers analytics, TikTok gives levers. Flash deals, urgency triggers, and real-time vouchers are tied to behavioral thresholds. On Shopify or Meta, sellers execute promotions through separate dashboards. TikTok closes that loop. Empowerment is not about control—it’s about precision at speed.

Source: TikTok

While Shopify and Meta require third-party tools, TikTok integrates everything natively. No dashboards. No delay.

1.2 ACE functions like a CRM, a content strategist, and an A/B testing engine.

It is wrapped into one system, powered by the TikTok algorithm. Sellers receive more than data. They get specific recommendations.

CRM (Customer Relationship Management): Traditional CRM tools like Salesforce or HubSpot capture leads, segment customers, and guide marketing strategy. ACE does this dynamically based on video behavior, auto-segmenting users into real-time personas.

Content Strategist: In a typical retail business, a brand or agency plans content calendars, evaluates creative hooks, and A/B tests scripts. ACE replaces this by generating data-driven recommendations for livestream topics, video styles, and creative timing—directly informed by user signals.

A/B Testing Engine: On Amazon or Shopify, sellers run experiments manually using dedicated dashboards or third-party apps. ACE automates testing in real time, adapting which offer, content, or discount is shown based on micro-conversions.

On Meta, testing is possible through Ads Manager and Creator Studio, but it lacks prescriptive guidance. Sellers often rely on post-campaign analytics and separate dashboards to interpret what worked.

In contrast, ACE automates testing in real time, adapting which offer, content, or discount is shown based on micro-conversions. TikTok’s system reduces the gap between insight and execution.

Point to note: Meta’s experimentation tools, such as Ads Manager and Creator Studio, allow some degree of split testing and creative optimization, but they lack the real-time, behaviorally responsive automation of TikTok’s ACE.

This integration gives TikTok sellers not just analytics, but prescriptive, real-time action plans.

It compresses the time between insight and execution. ACE doesn’t offer the modular flexibility of enterprise SaaS stacks. Instead, it wins by eliminating friction, collapsing multiple decision tools into one algorithmically-powered layer inside the TikTok interface.

Meta, on the other hand, still runs a modular stack. Ads Manager, Meta Pixel, and Creator Studio are powerful, but they serve an enterprise logic. Data, creative, and commerce are siloed workflows.

Large advertisers love the control. But SMBs and creators, who now make up the fastest-growing segment of digital sellers, want speed and native integration. Meta hasn’t collapsed those touchpoints. TikTok has.

ACE centralizes these steps natively within TikTok, giving sellers a single point of control for campaign logic, behavioral feedback, creative optimization, and real-time conversion levers—all without external plugins or dashboards.

1.3 Sellers act on signals, not summaries.

These signals include dwell time, replay rate, scroll speed, likes, comments, tap-throughs, and where users abandon a session. Each of these behaviors feeds into TikTok’s algorithm to dynamically adjust what is shown, when it’s shown, and how offers are packaged. It’s a live feedback loop, not a static report. PACE collapses awareness, engagement, and conversion into a single loop. What used to take hours of analysis now happens mid-scroll.

If you’re building a brand based on emotional resonance, real-time response, and influencer creativity, TikTok becomes the platform of record.

If you need logistics precision, trust, and deep SKU management, Amazon remains unbeatable.

Meta needs to restructures its workflow to match TikTok’s content-commerce loop, or Amazon accelerates its native discovery tools beyond bolt-on video widgets, both risk falling behind not just in features, but in foundational architecture. TikTok didn’t build social commerce. It collapsed the stack and made it default.

1.4 TikTok’s core strategy

Integrated systems reduce effort, raise speed, and improve stickiness.

They outperform modular stacks on:

retention,

conversion, and

cost-to-serve.

TikTok reduces CAC by collapsing the funnel. There's no handoff between ad, storefront, or checkout, every interaction happens in one surface. That means fewer drop-offs, lower spend per conversion, and faster ROI. In a platform economy, control over the customer journey is cost control.

As Harvard Business Review puts it: “Integrated ecosystems outperform modular models.” PACE is TikTok’s ecosystem, engineered to monetize behavior in real time.

This is vertical integration in software. TikTok owns every layer of the commerce stack: content, segmentation, creative tooling, incentives, checkout. No plugins. No handoffs. Every action feeds the next. That loop—fast, native, and self-improving—is the strategic edge.

Sellers do not need to install external apps or use third-party software to personalize offers, run promotions, or evaluate performance. Unlike Shopify, which relies on external apps like Klaviyo for email or ReConvert for upsells, or Amazon, where advanced analytics often live in separate dashboards, TikTok centralizes all seller functions.

Compared to Amazon and Shopify, ACE is structurally different. Amazon offers A/B testing, sponsored products, and brand customization tools. Shopify offers dashboards, funnels, and third-party apps for personalization.

TikTok’s design reduces friction and speeds up decision-making.

Point to note: while ACE may lack the depth or extensibility of open platforms, it wins in operational simplicity and behavioral precision. Sellers manage behavior flows that are already built into TikTok. ACE is less flexible than Shopify but more predictive.

BACK TO THE SUMMIT…

In Southeast Asia, sellers using ACE 2.0 report double-digit increases in GMV and repeat purchases. TikTok SEA (South East Asia) users spend over 81 minutes daily on the app. Shop Ads have led to a 3.9× lift in conversion. TikTok is not just helping users discover. It is converting them.

The Summit also highlighted the growing success of TikTok Shop Mall. Built to drive customer trust, TikTok Shop Mall sellers enjoy verified seller tags, premium campaign placements, and access to exclusive promotions. Between January and June 2024, brands on TikTok Shop Mall sellers saw sales grow 2.2x faster than those of the general marketplace, proof that TikTok Shop Mall is not just a badge of credibility, but a performance driver for brands.

This shows that TikTok Shop Mall is not just a badge of credibility, but a performance driver for brands. This presents a clear structural advantage for TikTok.

While Meta offers business verification and reputation signals like Meta Verified, it lacks a centralized promotional engine like TikTok Shop Mall. TikTok bundles credibility (verified seller tags), visibility (premium campaign slots), and performance incentives (exclusive promotions) into one integrated layer.

2. Why Meta and Amazon Still Struggle to Match TikTok’s Commerce Architecture

TikTok exposed a simple truth: vertical integration provides speed that creates winning moments. Modular platforms can’t move fast enough.

Amazon’s short-form experiment, 'Inspire,' was launched in late 2022 to mimic TikTok’s discovery feed—recommending influencer content and shoppable videos tailored to user interests. But it never scaled. By early 2025, Amazon shut it down.

Reports from TechCrunch and The Information confirmed Inspire failed to generate traction with users or creators, in part because it sat on top of Amazon’s legacy search-driven architecture rather than replacing it.

Inspire treated content as an add-on. TikTok treats it as infrastructure.

Amazon didn’t treat discovery as foundational.

Meta’s stack—Ads Manager, Pixel, Creator Studio—remains fragmented. It’s powerful for media buyers, slow for creators. Execution lives in one place. Insight in another. Sellers operate in pieces. TikTok collapsed the stack. That’s the delta.

TikTok is native. Meta is stitched. TikTok unifies targeting, content, and checkout in one flow. Meta relies on coordination. Amazon separates search from conversion. One captures emotion. The others analyze after the fact.

And the dollars prove it. In 2024, 60% of U.S. social commerce growth came from creator-led campaigns. These sellers don’t start with inventory—they start with audience.

A 2024 Influencer Marketing Trends Report (CreatorIQ) found that 66% of brands achieved higher ROI from creator content than from traditional digital ads.

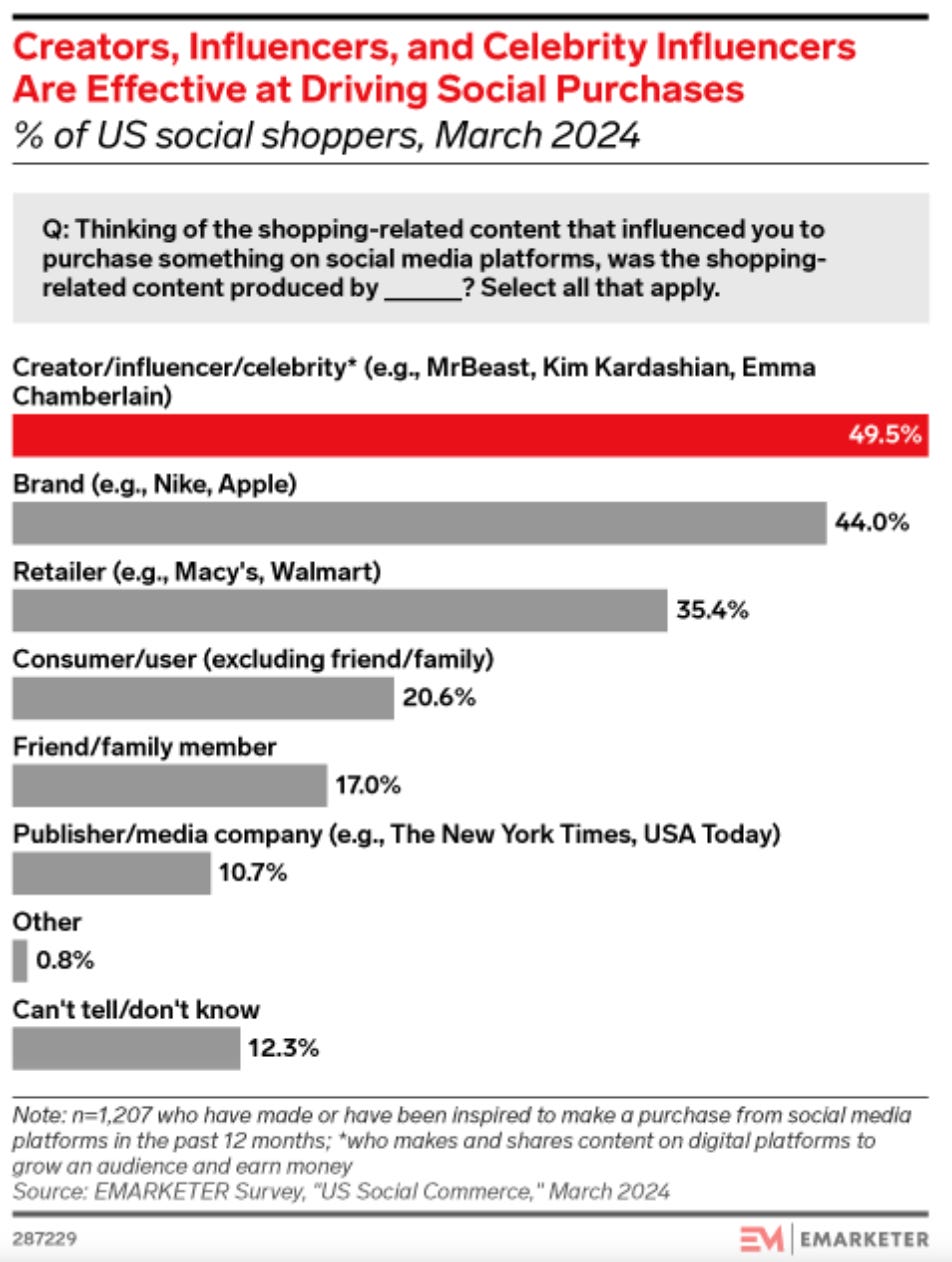

eMarketer (March 2024) reported that nearly 50% of U.S. social shoppers said a creator or influencer prompted their purchase.

TikTok enables this loop natively: film, post, convert. Meta still expects agencies. Amazon favors catalog sellers. TikTok empowers the creator as merchant.

The fact that TikTok is publishing these results in public domain shows enormous trust sellers and buyers are placing on TikTok. In contrast, Meta has not released marketplace-wide GMV growth benchmarks for its Shops product across the same timeframe. While Meta has reported increasing adoption of Reels Ads and Checkout integrations, there is no evidence of a similar ecosystem-wide acceleration.

Again TikTok is catering to SEA audience and their needs do vary from US or other EU markets but ACE framework is surely acting as a major win for TikTok.

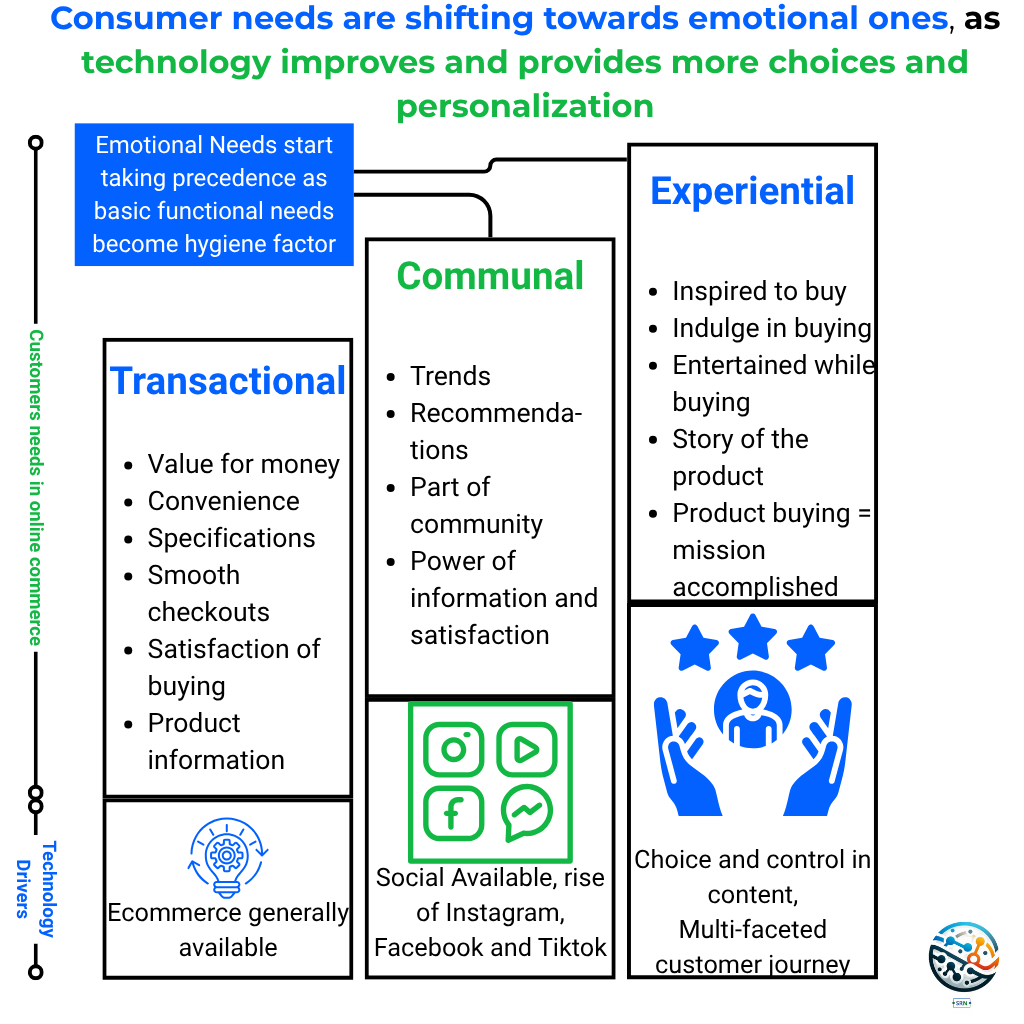

This data is evident of shifting consumer preferences. A 2024 TikTok-Accenture study found that 79% of APAC consumers value content over coupons. 73% join content communities. 81% expect seamless browse-to-buy experiences. TikTok’s design makes it ideal to serve this behavior.

The app is built around a content-first, feed-based interface where product discovery happens naturally as users scroll through videos. Unlike traditional platforms where shopping is a separate, deliberate action, TikTok embeds commerce into entertainment.

3. Behavior (Personalization) Is the New Intent. TikTok Seems to Knows the Difference.

This integration allows users to move seamlessly from watching content to engaging with products and completing purchases, all without leaving the app.

The algorithm personalizes video recommendations based on real-time signals, which helps sellers deliver the right message to the right user at the moment of peak interest.

I define “Peak interest” as the critical point when a user’s attention is fully engaged, emotions are activated, and purchase intent can be nudged with minimal resistance.

TikTok’s algorithm identifies these signals, such as video completion rates, dwell time, likes, comments, and rapid replays, and dynamically prioritizes content aligned with those micro-moments.

Instagram’s (Meta) algorithm focuses on engagement for content discovery, but does not dynamically optimize commerce interactions based on emotional micro-moments. Meta lacks an equivalent to ACE’s closed-loop feedback system that converts behavioral signals into specific seller actions.

Sellers can then trigger time-sensitive offers like flash deals or exclusive vouchers in those exact windows. This is not just personalization. It’s real-time, emotionally calibrated targeting that turns passive engagement into active buying.

This tight coupling of content, context, and commerce meets the rising consumer demand for frictionless, emotionally driven shopping experiences.

This real-time, emotionally calibrated targeting makes personalization not just functional but strategic.

From my perspective, personalization should not just show users what they like. It should predict why they will care. ACE 2.0 enables this. It does not simply label someone as a budget shopper. It identifies when they are in that mindset, what offer will motivate them, and which content format will make them stop scrolling.

At every stage of the funnel, you can supercharge your success with TikTok’s full-funnel suite of advertising solutions. Our data shows that when brands run Shop Ads on TikTok, they see a 129% increase in median GMV

4. My opinion, This is a threat to AMAZON.

Amazon relies on intent-based shopping. Users go there to complete a task.

TikTok drives interest-based discovery. Users find what they didn’t know they wanted. TikTok doesn’t need better logistics.

TikTok’s strategy focuses on top-of-the-funnel conversion rather than reliable delivery infrastructure. It excels at turning curiosity into purchase, a behavior we can call 'moment-of-interest conversion.'

This is where impulsive behavior, emotional arousal, and content alignment trigger buying decisions.

However, unlike Amazon, TikTok does not yet offer consistent delivery experiences, which remains Amazon’s competitive edge. Amazon’s fulfillment infrastructure is trusted by hundreds of millions of users, and reliability is core to its value proposition.

According to a 2023 PwC global consumer insights survey, 74% of online shoppers prioritize delivery reliability over product price. Deloitte’s research also shows that 65% of customers who experience delays or damaged packaging will not repurchase. Forrester ranks post-purchase logistics as the top driver of long-term loyalty.

TikTok may win the first click through emotional engagement, but Amazon wins the trust with consistent fulfillment.

However, in dollar terms, global e-commerce spending is still heavily intent-driven, with Amazon and Alibaba commanding over $1.5 trillion in GMV. Interest-based commerce is rising fast. Shoppertainment in APAC alone is expected to surpass $1 trillion by 2025. TikTok’s model captures this momentum by monetizing attention and emotion, not just product search.

As these models converge, interest-driven platforms may erode share from traditional search-first platforms unless they adapt quickly.

Bloomberg and Business Insider report that TikTok is winning Gen Z. TikTok Shop now drives over $1 billion in monthly GMV in the U.S. It hit $100 million in a single day on Black Friday 2024. Amazon has started testing video and influencer tools to catch up.

This is behavioral commerce where content generates demand. TikTok is positioned to lead this shift.

ACE 2.0 and PACE are not marketplace upgrades. They form an algorithmic engine for emotional commerce. Amazon may not lose immediately. But it loses user attention, one scroll at a time.

If TikTok holds this momentum, discovery won’t begin with search. It will begin with a swipe.