Read This If You Want a Simple Hack to Increase Your Post-Purchase Conversion Rate by 5% — Without AI or Engineering

A vendor-tested playbook to stop revenue leaks, regain control, and turn post-purchase into a profit center.

Hey, Nikhil here—welcome to The Silk Road Nexus. Twice a week, I unpack what’s shaping the world of supply chain—from deep dives on strategy and optimization to real stories from the frontlines of global commerce.

If this is your first read, you’re right on time to join a growing circle of operators, thinkers, and builders reimagining how the world moves.

This is your ultimate guide to reclaiming the post-purchase experience, boosting repeat sales, and choosing the right tracking solution with confidence. I’ve analyzed the top vendor platforms, compared real-world implementations, and mapped the business impact — all to solve one of eCommerce’s most ignored revenue leaks: the moment after checkout.

AI is solving everything from fraud detection to generative design. But some problems don’t need AI — they just need a go/no-go decision. Today’s problem is that simple.

I recently ordered a blazer from Bonobos, a leading men's fashion brand. When I clicked “Track My Order” in their shipment email, I was redirected to a generic AfterShip/UPS carrier page, not a Bonobos-branded tracking experience. I was shocked (NOT ABLE TO FIND THE SCREENSHOT I TOOK):

No Bonobos logo, colors, or UX — just a 3rd-party carrier tool.

Zero opportunities for upsells, loyalty nudges, or reassurance during a high-emotion moment.

I researched this is a big problem for micro and small brands. It shouldn’t be.

Brands are losing tens of millions in revenue by handing over the most emotionally charged moment — post-purchase tracking — to FedEx, UPS, and DHL.

This is a GO decision. No AI required. Just execution.

You're not just losing customer trust when you redirect them. You're losing the highest-intent moment to sell again.

This guide walks you through:

the overlooked economics of post-purchase engagement

tools that can be implemented in under two weeks

how to evaluate and choose the right vendor

and the decision frameworks for immediate action

After reading this, you should go implement and capture lost revenue.

If you're in eCommerce and you're still treating the tracking experience as an afterthought, this is your wake-up call.

🔒 The Sin of Passing the Customer to Carrier to Track the Product Delivery

You’re losing up to 4.7% chance of converting customers to re- or cross-sell.

In eCommerce, the sale isn’t the end of the customer journey — it’s the start of a fragile trust loop.

McKinsey’s Customer Loyalty Loop

After a customer clicks “Buy” (moment of purchase), they enter a phase of emotional anticipation.

Over 90% of them will track their order, and 20% check multiple times a day. This makes the tracking page one of the most visited — and emotionally loaded — touchpoints in the entire journey.

Yet more than 60% of brands still outsource this moment to shipping carrier websites like UPS or FedEx.

This creates an emotional breach during the “Wait → Check Tracking” phase — a rupture point in the loyalty cycle.

Customers check tracking 4.6 times per order, yet when brands send them off-site or provide inaccurate dates, it leads to poor consequences.

❌ Consequences

LOSS OF LOYALTY (Trust)

Redirects increase uncertainty and erode the brand-customer bond.

WISMO (Where Is My Order) tickets spike as clarity drops.

Branded tracking solutions have been shown to reduce WISMO by 38–63%.

NO VISIBILITY INTO CUSTOMER INTERACTION

Offsite tracking hides behavior.

Brands lose data on how often customers check, where delays frustrate them, and when to intervene.

No data = no proactive service, no feedback loop.

NO UPSELL OPPORTUNITY

Each tracking page visit is high-intent and high-frequency.

Redirects hand off that attention to UPS or FedEx — along with the chance to upsell or recommend.

The Result: Lost Margin

This quiet redirect means brands lose control of the post-purchase experience and miss revenue that carries zero customer acquisition cost (CAC).

Low Marginal Cost + High Intent = High Profit

Low Marginal Cost + High Intent = High Profit

In digital economics, every additional customer interaction should cost nearly zero.

That’s leverage.

The tracking page embodies this:

Cost to serve = near zero

Attention = earned, repeated, high intent

You’ve already paid to acquire the customer.

Now they’re coming back to you — 4.6 times — and you’re sending them away.

What You Can Do Instead: Own the Moment

Embedding product recommendations or reorder prompts on branded tracking pages converts attention into action — repeat purchases, upsells, or stronger loyalty.

ReConvert has observed 1.7%–4.7% conversion on post-purchase offers

Average upsell value: $50–$200

Travelpro achieved a 0.4% repeat purchase rate within 30 minutes of tracking page visits

What Good Looks Like

Embed tracking directly in brand.com

Proactively communicate delays or updates

Add lightweight upsell or loyalty hooks on tracking page

Keep the customer emotionally engaged post-purchase

Buy vs. Build: How to Implement Branded Tracking

Most eCommerce brands don’t need to build this in-house — tools exist to launch branded tracking within 1–2 weeks.

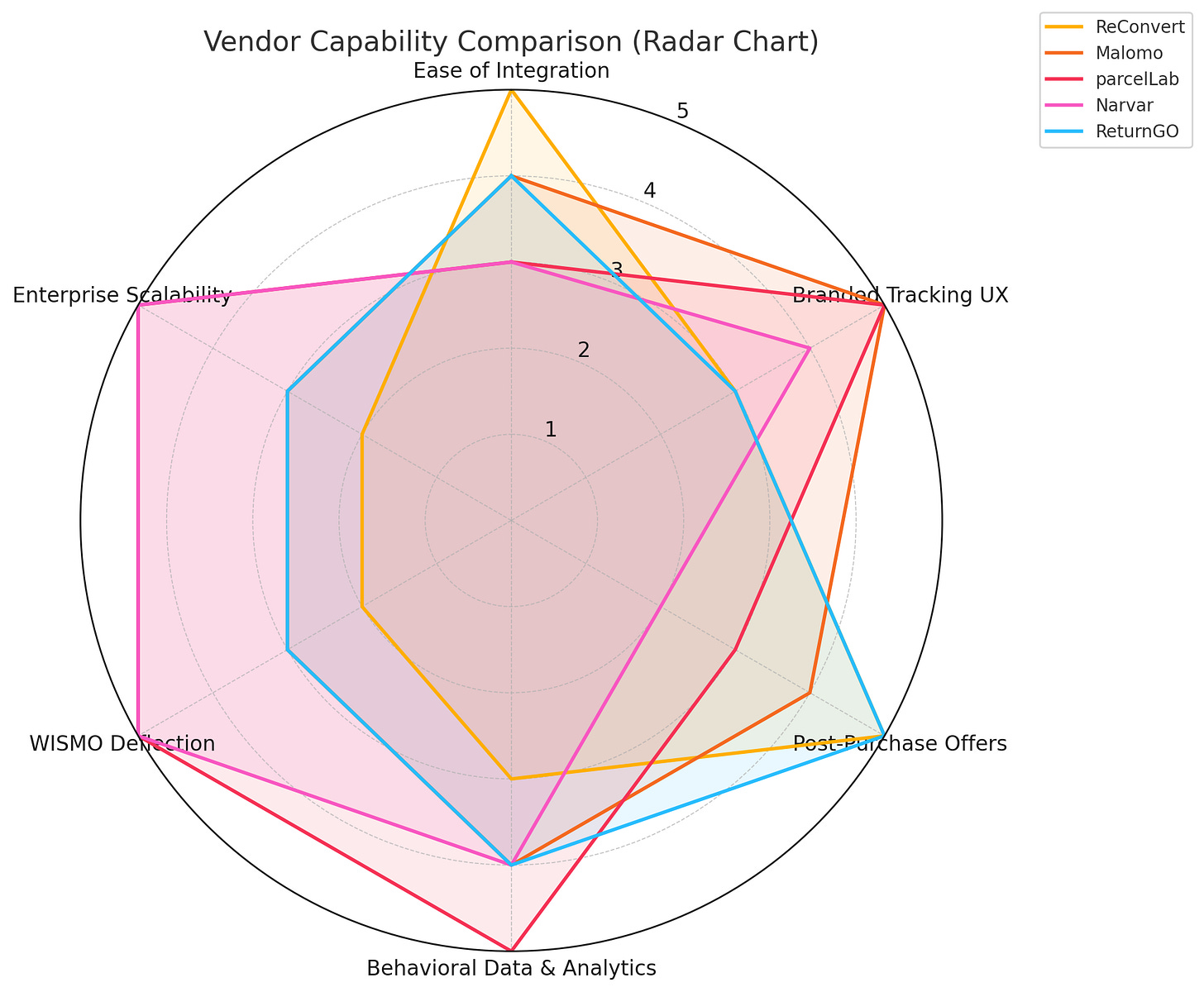

Vendor Comparison Radar Chart

Methodology Behind the Radar Chart

To objectively compare post-purchase tracking vendors, I developed a capability-based evaluation framework focused on six business-critical dimensions. Each vendor was scored on a 1–5 scale based on public documentation, customer case studies, demo environments, and integration guides.

🎯 Evaluation Criteria

Each of the six dimensions was chosen for its direct connection to either:

Revenue impact (via monetization and conversion),

Customer experience (via tracking UX and WISMO deflection), or

Operational scalability (via integrations and analytics).

1. Ease of Integration

Benchmarked setup time, partner app reviews (e.g., Shopify app store), API documentation clarity, and time-to-live based on customer stories.

Example: ReConvert and parcelLab scored highest due to simple, low-code deployment.

2. Branded Tracking UX

Assessed customization depth, ability to use custom domains, control over layout, and mobile responsiveness.

Example: Malomo enables full customization, while ReturnGO uses more templated designs.

3. Post-Purchase Offers

Measured availability of upsell, reorder, and cross-sell modules, plus dynamic offer injection capabilities.

Example: ReConvert integrates directly with product catalogs and offers upsell blocks.

4. Behavioral Data & Analytics

Evaluated depth of reporting (e.g., view frequency, rage clicks), heatmaps, funnel data, and dashboard features.

Example: Narvar and Malomo scored highest for detailed engagement tracking.

5. WISMO Deflection

Scored based on the availability of proactive alerts (e.g., shipment delays), self-service portals, and integration with support platforms.

Example: Narvar deflects WISMO via automated comms and proactive CS workflows.

6. Enterprise Scalability

Evaluated features like SSO, multi-brand support, SLAs, custom APIs, and global deployment capabilities.

Example: Narvar supports enterprise features, ReConvert is more SMB-focused.

Scoring Logic

Each vendor was rated on a 1 (poor) to 5 (excellent) scale for each dimension:

Sources used:

Vendor Documentation (APIs, Feature Lists)

App Store Reviews

Customer Case Studies & Technical Write-Ups

Hands-On Trials and Demos