How to Choose Between Gig and Professional Delivery for the Last Mile: A Three-Step Mathematical and Q&A Framework

Backed by seven studies and two proprietary surveys, this framework helps brands choose the right delivery model, personalize last-mile experiences, and build a reliable network using trust anchors.

Hey, Nikhil here—welcome to The Silk Road Nexus. Twice a week, I unpack what’s shaping the world of supply chain—from deep dives on strategy and optimization to real stories from the frontlines of global commerce.

If this is your first read, you’re right on time to join a growing circle of operators, thinkers, and builders reimagining how the world moves.

This week’s deep dive covers the Gig Economy in last-mile delivery.

We’re seeing a clear shift, brands are leaning into gig models, but customers remain hesitant. This disconnect is creating friction, where loyalty weakens and personalization breaks down.

DO SUBSCRIBE!!! THANK YOU

From groceries to furniture, the logistics playbook is being rewritten to favor flexibility over relationship.

But it raises an important question: is this model survivable in the long run? Or do consumers ultimately prefer their packages delivered by trained professionals?

To explore this, I conducted a survey asking respondents whom they trust more for last-mile delivery—crowdsourced gig drivers, professional drivers, or autonomous robots and droids. The results were telling: 58% of respondents preferred professional drivers, signaling that trust, not just speed, remains central to the delivery experience.

NOTE TO READERS:

I started this research with a clear hypothesis: professional delivery networks don’t just fulfill logistics, they reinforce brand trust in ways gig models often cannot. This essay tests that hypothesis through three lenses: operational performance, brand perception, and economic efficiency. The goal is not to dismiss gig-based delivery, but to critically assess where and when it aligns or conflicts with brand strategy

To make sense of this tradeoff, I use a Tension–Contradiction–Synthesis framework to guide the analysis.

The tension: Gig models promise speed and flexibility in an era where customer expectations are rising.

The contradiction: Despite operational gains, consumers still overwhelmingly trust professional drivers — suggesting that reliability, not speed, may be the true loyalty driver.

The synthesis: Brands must evaluate logistics not just by cost or time, but by how the delivery experience reinforces long-term trust and brand equity.

From this foundation, I analyze the gig vs. professional model through two operational lenses:

Personalization: Can gig drivers maintain or enhance brand experience?

Cost Efficiency: How do gig models compare with professional carriers in terms of operational savings?

In this essay, I also propose a THREE-STEP framework to make a brand level decision on what of Carrier To Choose to continue to build brand awareness. This framework uses:

Mathematical Dimension - To evaluate cost vs time function for each delivery using a Total Cost to Serve (TCS) model.

Conceptual Dimension (Brand Strategy)

Philosophical Dimension (Trust vs. Scale)

Each lens is analyzed using peer-reviewed research, platform case studies, and our proprietary survey.

FOUR THINGS You’ll Learn in This Essay:

Why 58% of consumers prefer professional drivers—even when delivery speed is identical

A three-step decision framework to choose the right last-mile model

How Total Cost to Serve (TCS) captures tradeoffs between speed, trust, and cost

KPI-based benchmarking for gig vs. professional delivery performance

The Costly Final Mile

Last mile delivery, the final leg in the logistics chain, is both the most expensive and the most customer-facing segment. It constitutes approximately 41% of total logistics costs (Capgemini, 2022).

This stage starts when the parcel leaves a local distribution hub and ends at the customer’s doorstep, involving multiple stakeholders: dispatch managers, delivery agents (DAs), and customer service teams.

What makes the last mile particularly challenging is its complexity including:

high variation in routes,

limited economies of scale, and

ever-evolving customer expectations.

The Gig Economy's Entry into Last Mile Logistics

The pandemic catalyzed a labor shortage across traditional logistics providers, revealing limitations in their scalability.

Gig work a task-based labor through digital platforms - emerged as a flexible and scalable alternative.

Companies like Veho, UniUni, GoBolt, TForce, and Amazon Flex now leverage gig drivers to meet demand spikes.

Gig platforms are appealing for several reasons:

Low operational overhead: No fixed warehousing or fleet maintenance.

Rapid labor onboarding: Drivers only need a car, license, and background check.

Scalability: Platforms can adapt rapidly to peak season needs.

This model disrupted traditional carriers like FedEx, UPS, and DHL by offering faster, cheaper alternatives.

Personalization in the Gig Model

What the Research Says

A growing body of work explores how delivery personnel influence customer experience.

One such study, Emotional Reactions to Driver Behavior in Last Mile Logistics, notes that driver demeanor, punctuality, and care - impact not only satisfaction but also repurchase intentions.

Another paper, Experience Dimensions in Unattended Home Delivery, highlights that consumers perceive delivery quality through subtle cues: package condition, drop-off interaction, and perceived professionalism.

Gig drivers, due to their transient nature, lack brand training and standardized service protocols. According to Consumer Participation in Last Mile Logistics Decisions, this inconsistency in human touch points degrades the brand experience over time.

Survey Insights (Proprietary Study, 2025)

I also conducted a survey, asking,

NOTE: Audience: primarily professionals in commerce, retail ops, and supply chain roles

Survey 1

“Who would you trust receiving your parcel or shipment from?” The survey yielded 110 responses across LinkedIn, and industry forums, offering a statistically meaningful glimpse into consumer trust preferences within last mile logistics.

Survey 2

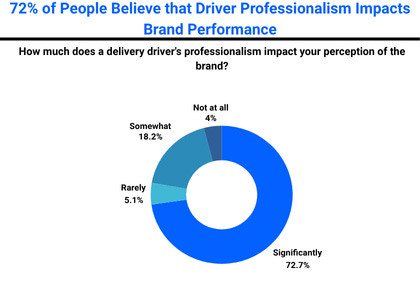

To deepen the trust analysis, I conducted a follow-up survey asking: “How much does a delivery driver’s professionalism impact your perception of the brand?” Sample size 76 Participants. This reinforces the idea that delivery is not just functional — it’s experiential. The professionalism of the driver becomes a proxy for brand quality in the customer’s mind.

Though I included robots in the survey as a comparison, this essay focuses only on gig and professional models—where real operational tradeoffs exist today.

Despite the rise of contactless and gig-based delivery models, consumer trust in professional carriers remains significantly higher, even when delivery timeliness is identical. Our second survey deepens this insight: 73% of respondents said driver professionalism directly shapes how they perceive the brand.

This suggests that trust in delivery is shaped by more than operational performance, it’s about emotional assurance. Customers equate professionalism with reliability, which stems from consistency in appearance, behavior, and perceived accountability.

At a psychological level, uniformed drivers and branded vehicles signal responsibility and care, reinforcing the idea that “someone stands behind this delivery.”

At a philosophical level, this reflects a preference for structure, hierarchy, and institutional reliability, qualities gig models often lack due to their transactional and temporary nature.

Even when delivery is on time, the absence of brand-linked identity in gig drivers introduces doubt. In high-value or emotionally sensitive shipments, familiarity and formal cues become proxies for trust. Brands that treat delivery as an extension of the customer experience, not just logistics, create stickier, more trusted relationships.

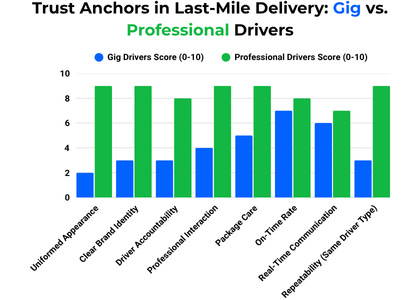

To make this even more tangible, I developed a Trust Anchors framework, comparing gig and professional drivers across eight key service cues, such as accountability, uniformed appearance, and repeatability.

The chart below visualizes this comparison. Professional networks consistently outperform gig models across nearly every trust anchor. This reinforces the idea that trust is not just earned through delivery speed—but through the experience around it.

My View

Gig drivers can complete the delivery, but they don’t build brand equity. In high-value or emotionally sensitive shipments, their lack of standardized training and weak alignment with brand values creates inconsistency. This inconsistency reduces customer trust.

This isn’t just theoretical. In our Trust Anchors analysis, professional drivers consistently scored higher than gig drivers across key service cues. These include accountability, repeatability, uniformed appearance, and care in package handling. These traits are not cosmetic. They serve as visible and behavioral signals that reinforce brand reliability.

Even Amazon, despite its logistics scale, uses Amazon Flex cautiously. The company prefers its Delivery Service Partner (DSP) network. This suggests a deliberate choice. When delivery impacts customer satisfaction, even highly optimized businesses prefer consistency and control over flexibility.

Survey data supports this approach.

A significant majority of customers associate trust, care, and professionalism with traditional carriers. This is true even when gig drivers meet the same delivery window. That trust premium influences more than perception. It shapes repeat purchase behavior, increases Net Promoter Scores, and strengthens brand loyalty over time.

Cost Efficiency in Crowdsourced Logistics

Comparative Cost Structures

Gig platforms reduce costs by 25–40% (Mathematics 2023 study) compared to traditional carriers. These savings stem from asset-light models, pay-per-task labor, and minimized training costs. Traditional carriers, burdened by unionized labor, compliance infrastructure, and fixed fleets, find it hard to match these rates.

Peer-Reviewed Evidence

In Probability Estimation and Structured Output Prediction for Learning Preferences in Last Mile Delivery, researchers noted that gig systems are more adaptable for cost optimization, especially when route predictability is low. However, this flexibility comes at a cost: inconsistent experience and high turnover.

Platform-Level Performance

Veho: Claims 99% on-time delivery. Operates primarily in dense Tier-1 cities. Customer satisfaction is high due to proactive communication and real-time tracking.

UniUni: Specializes in Canadian and U.S. cross-border e-commerce. Focuses on small parcels and works with local gig fleets. Known for speed but struggles with damaged parcels.

TForce: Grew aggressively during the pandemic. Operates in hybrid gig–professional models. Customer reviews cite inconsistency in rural zones.

My View

In geographies with dense urban populations and predictable delivery demand, gig delivery offers clear advantages from a cost-saving perspective. Its asset-light model and elastic labor force allow rapid scaling without the fixed overheads of traditional carriers.

However, in less mature markets or areas that demand specialized handling or consistent service touchpoints, professional networks still provide better reliability and control over the customer experience.

A Strategic Framework: Choosing Your Last Mile Model

To help brands decide between gig and professional delivery, I propose a three-dimensional framework:

Mathematical Dimension (Cost/Time Function)

Use Total Cost to Serve (TCS) models, which provide a comprehensive accounting framework to calculate the full cost of delivering a product to a specific customer or market segment.

TCS includes not just transportation and warehousing costs, but also the 'hidden' costs often overlooked in traditional cost analyses. These include failed delivery attempts, customer support overhead, reverse logistics, customer churn due to poor experience, and loss in brand equity.

TCS enables businesses to quantify trade-offs between speed, cost, and service quality across different delivery modalities, including gig-based and professional networks, thereby allowing more strategic allocation of logistics investments.

Mathematical Framework for Total Cost to Serve (TCS) Optimization

To effectively deploy a TCS-based decision model, brands can use the following structured approach:

Define Cost Buckets: Break down total cost into direct and indirect components, such as:

Direct: driver compensation, fuel, delivery time, vehicle usage.

Indirect: customer support costs, failed delivery rate, refunds, and churn risk.

Parameterize the Model: Use weighted cost variables for each delivery mode (gig vs professional), calibrated by:

Historical performance metrics (First Attempt Success Rate, On Time Delivery).

Region-specific delivery density.

Sensitivity coefficients for customer dissatisfaction or service delays.

Model Structure:

Objective Function: Minimize

Total Cost to Serve (TCS) = Σ (Ci × Wi),

where

Ci = cost element,

Wi = weight based on business impact.

Constraints:

Delivery window (≤ X hours),

Service coverage (≥ Y zip codes), and

NPS threshold (≥ Z).

Incorporate Stochastic Elements: Introduce probability distributions to simulate:

Traffic disruptions (e.g., normal/Gaussian delays).

Weather conditions (e.g., Bernoulli variable for disruptions).

Driver availability (Poisson process for gig density over time).

Simulate and Calibrate: Run Monte Carlo simulations or agent-based models to evaluate multiple delivery scenarios across hybrid networks.

Output: Optimize delivery modality recommendations by geography, order value, and customer segment using TCS outcomes. These outputs can inform dispatch orchestration engines or procurement strategies.

This mathematical foundation bridges operations with brand outcomes, quantifying not just efficiency but service reliability and experience equity.

Incorporate stochastic variables for traffic, weather, and density.

Conceptual Dimension (Brand Strategy)

If delivery is part of the value proposition (e.g., high-end furniture or perishables), professional networks are aligned.

If speed trumps brand touch-points (e.g., small parcel e-commerce), gig suffices.

Philosophical Dimension (Trust vs. Scale)

Ask: What does your brand want to be remembered for—speed or service?

Design logistics choices that reinforce brand identity.

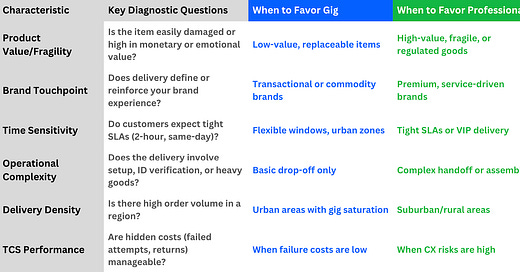

Using this approach I have been able to distill the requirements for Gig vs Professional delivery requirements for a brand. Ask these questions.

⚠️ Rate Dilution and Volume Fragmentation

A critical operational consequence of splitting volume between gig and professional carriers is dilution of negotiated rates. Here's why that matters:

Carrier Pricing Is Volume-Based: Professional carriers offer favorable rates when they can guarantee predictable, consolidated volume.

Fragmented Volume Reduces Leverage: When a brand shifts part of its deliveries to gig models, the reduced volume with the carrier can trigger:

Higher per-shipment rates

Lower service prioritization

Removal of volume-based incentives

Operational Implication: While gig saves on surface-level cost per delivery, losing bulk-negotiation leverage with professional networks can lead to increased overall TCS—especially for long-haul, rural, or high-SLA deliveries.

Strategic Recommendation

To mitigate this, brands should:

Segment deliveries by product and geography, not arbitrarily. Retain core volume with professionals where the brand benefit and rate leverage are highest.

Use gig networks for overflow, seasonal spikes, and select SKUs (e.g., clearance, promotional items).

Negotiate hybrid contracts with professional carriers that include volume floors to protect pricing tiers.

Key Performance Indicators (KPIs)

1. On-Time Delivery Rate (OTD)

Measures the percentage of deliveries made on or before the promised time.

Why: In the gig economy, variability in driver schedules can lead to missed or delayed deliveries. OTD tracks reliability, which directly impacts customer trust and repeat purchases.

2. First Attempt Success Rate (FASR)

Measures the success of delivery on the first attempt without requiring redelivery.

Why: Gig drivers may lack route familiarity or delivery experience, leading to failed first attempts. A high FASR reduces redelivery costs and enhances operational efficiency.

3. Net Promoter Score (NPS) – Delivery Experience

Captures customer satisfaction based on likelihood to recommend, using a 0–10 scale.

Why: Customer loyalty in gig-based models depends on service consistency and professionalism. NPS reveals how the delivery experience shapes brand perception.

Where:

Promoters = respondents rating 9–10

Passives = respondents rating 7–8

Detractors = respondents rating 0–6

4. Delivery Cost per Order (DCO)

Quantifies the operational cost to complete a single order delivery.

Why: Crowdsourced models often promise lower costs, but hidden inefficiencies can erode margins. DCO helps assess true cost competitiveness across delivery types.

5. For Carriers: Driver Retention Rate (Gig) vs Customer Complaint Ratio (Pro)

a. Driver Retention Rate (Gig Model)

Measures the percentage of gig drivers retained over a specific period.

Why: High turnover among gig drivers can degrade delivery quality and increase onboarding costs. Retention signals workforce stability and service continuity.

b. Customer Complaint Ratio (Pro Model)

Measures customer complaints relative to total deliveries.

Why: In contrast to gig models, professional networks are judged by consistency and accountability. Complaint ratio measures service breakdowns that hurt brand loyalty.

When viewed holistically, gig models score well on cost per order and adaptability. But they consistently underperform on trust-aligned metrics like NPS, complaint ratio, and first attempt success — metrics that ultimately drive repeat business.

Case Study: Why the Gig Model Works in India

India has over 3 million gig workers in last mile logistics, comprising 20% of the total national gig workforce. Growth in this segment is 21% annually. Instead of building optimization engines, Indian retailers scaled through easy onboarding and high population density.

Commerce Minister Piyush Goyal once said: “We are building an army of drivers delivering goods to couch potatoes.” The quote captures both the opportunity and the concern. Gig delivery works in India due to:

Demographics: Abundant labor pool.

Cost Structures: Low living costs allow gig income to be viable.

Urban Density: Short routes and repeatable delivery paths.

However, this model may not scale outside emerging markets. Educational underemployment is rising, with 32% of gig drivers holding college degrees.

9. Conclusion

Gig delivery is a powerful tool for modern logistics. It offers flexibility and cost savings. But it also brings variability, weakens brand touchpoints, and poses ethical questions about labor quality.

Retailers must choose wisely. Not all deliveries are equal. Not all customers are the same. When delivery becomes a transaction, not a relationship, brands lose an opportunity to stand out.

To lead in the next era of fulfillment, brands must balance operational elasticity with human experience. The last mile is not just a place. It is a moment. Make it count.

"In the age of frictionless commerce, the final mile isn’t just a logistics problem—it’s a brand-building moment. For brands that want to scale with trust, the real decision isn’t about who can deliver faster. It’s about who your customer wants to see at the door.”